Summary

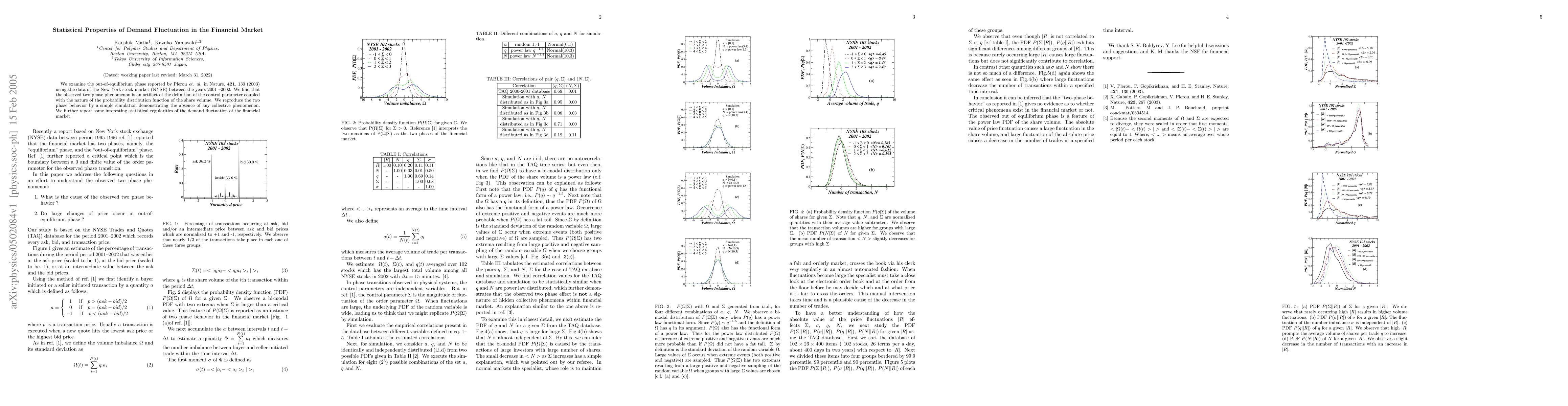

We examine the out-of-equilibrium phase reported by Plerou {\it et. al.} in Nature, {\bf 421}, 130 (2003) using the data of the New York stock market (NYSE) between the years 2001 --2002. We find that the observed two phase phenomenon is an artifact of the definition of the control parameter coupled with the nature of the probability distribution function of the share volume. We reproduce the two phase behavior by a simple simulation demonstrating the absence of any collective phenomenon. We further report some interesting statistical regularities of the demand fluctuation of the financial market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNovel Market Temperature Definition Through Fluctuation Theorem: A Statistical Physics Framework for Financial Crisis Prediction

Mehdi Ramezani, Masoome Ramezani, Fereydoun Rahnama Roodposhti et al.

Comments (0)