Summary

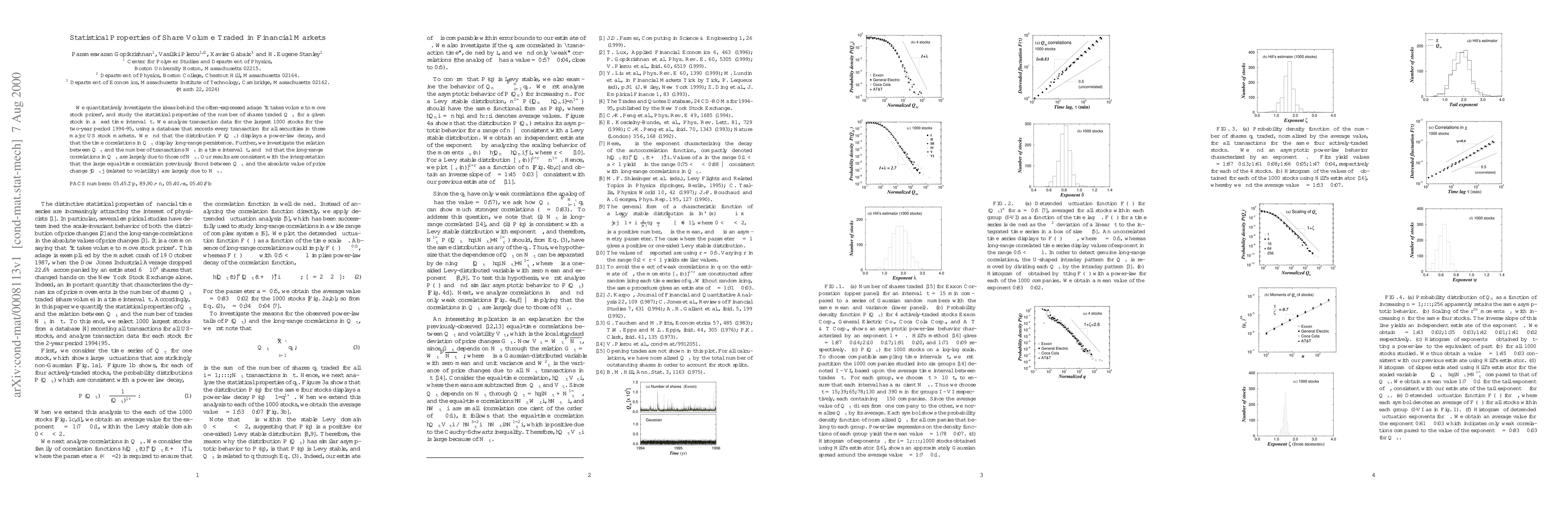

We quantitatively investigate the ideas behind the often-expressed adage `it takes volume to move stock prices', and study the statistical properties of the number of shares traded $Q_{\Delta t}$ for a given stock in a fixed time interval $\Delta t$. We analyze transaction data for the largest 1000 stocks for the two-year period 1994-95, using a database that records every transaction for all securities in three major US stock markets. We find that the distribution $P(Q_{\Delta t})$ displays a power-law decay, and that the time correlations in $Q_{\Delta t}$ display long-range persistence. Further, we investigate the relation between $Q_{\Delta t}$ and the number of transactions $N_{\Delta t}$ in a time interval $\Delta t$, and find that the long-range correlations in $Q_{\Delta t}$ are largely due to those of $N_{\Delta t}$. Our results are consistent with the interpretation that the large equal-time correlation previously found between $Q_{\Delta t}$ and the absolute value of price change $| G_{\Delta t} |$ (related to volatility) are largely due to $N_{\Delta t}$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)