Summary

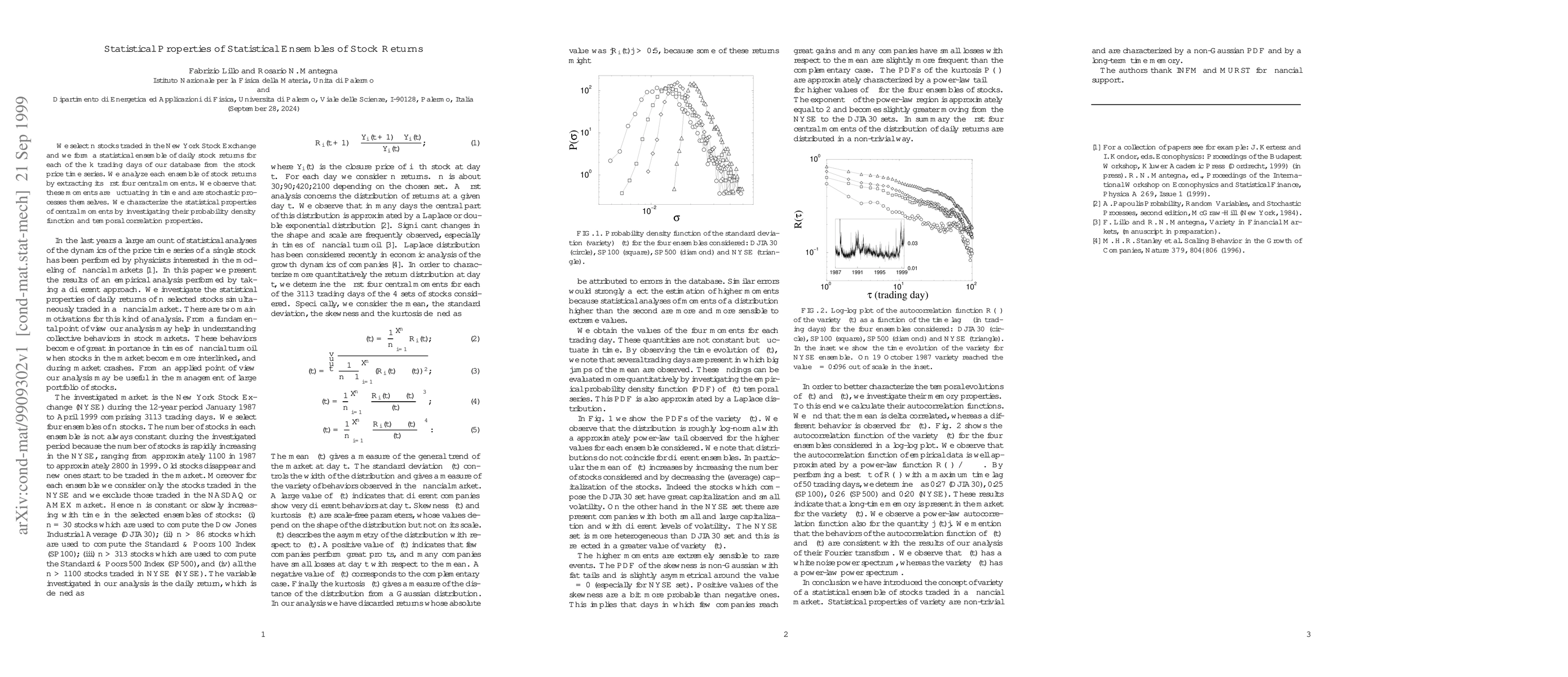

We select n stocks traded in the New York Stock Exchange and we form a statistical ensemble of daily stock returns for each of the k trading days of our database from the stock price time series. We analyze each ensemble of stock returns by extracting its first four central moments. We observe that these moments are fluctuating in time and are stochastic processes themselves. We characterize the statistical properties of central moments by investigating their probability density function and temporal correlation properties.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)