Authors

Summary

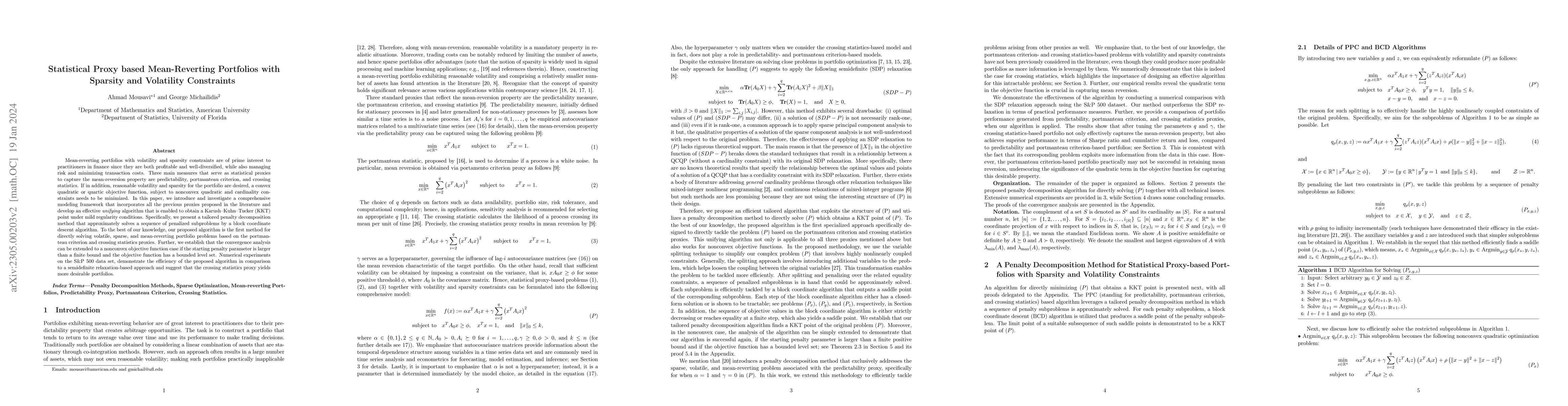

Mean-reverting portfolios with volatility and sparsity constraints are of prime interest to practitioners in finance since they are both profitable and well-diversified, while also managing risk and minimizing transaction costs. Three main measures that serve as statistical proxies to capture the mean-reversion property are predictability, portmanteau criterion, and crossing statistics. If in addition, reasonable volatility and sparsity for the portfolio are desired, a convex quadratic or quartic objective function, subject to nonconvex quadratic and cardinality constraints needs to be minimized. In this paper, we introduce and investigate a comprehensive modeling framework that incorporates all the previous proxies proposed in the literature and develop an effective unifying algorithm that is enabled to obtain a Karush-Kuhn-Tucker (KKT) point under mild regularity conditions. Specifically, we present a tailored penalty decomposition method that approximately solves a sequence of penalized subproblems by a block coordinate descent algorithm. To the best of our knowledge, our proposed algorithm is the first for finding volatile, sparse, and mean-reverting portfolios based on the portmanteau criterion and crossing statistics proxies. Further, we establish that the convergence analysis can be extended to a nonconvex objective function case if the starting penalty parameter is larger than a finite bound and the objective function has a bounded level set. Numerical experiments on the S&P 500 data set demonstrate the efficiency of the proposed algorithm in comparison to a semidefinite relaxation-based approach and suggest that the crossing statistics proxy yields more desirable portfolios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)