Summary

At high levels, the asymptotic distribution of a stationary, regularly varying Markov chain is conveniently given by its tail process. The latter takes the form of a geometric random walk, the increment distribution depending on the sign of the process at the current state and on the flow of time, either forward or backward. Estimation of the tail process provides a nonparametric approach to analyze extreme values. A duality between the distributions of the forward and backward increments provides additional information that can be exploited in the construction of more efficient estimators. The large-sample distribution of such estimators is derived via empirical process theory for cluster functionals. Their finite-sample performance is evaluated via Monte Carlo simulations involving copula-based Markov models and solutions to stochastic recurrence equations. The estimators are applied to stock price data to study the absence or presence of symmetries in the succession of large gains and losses.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

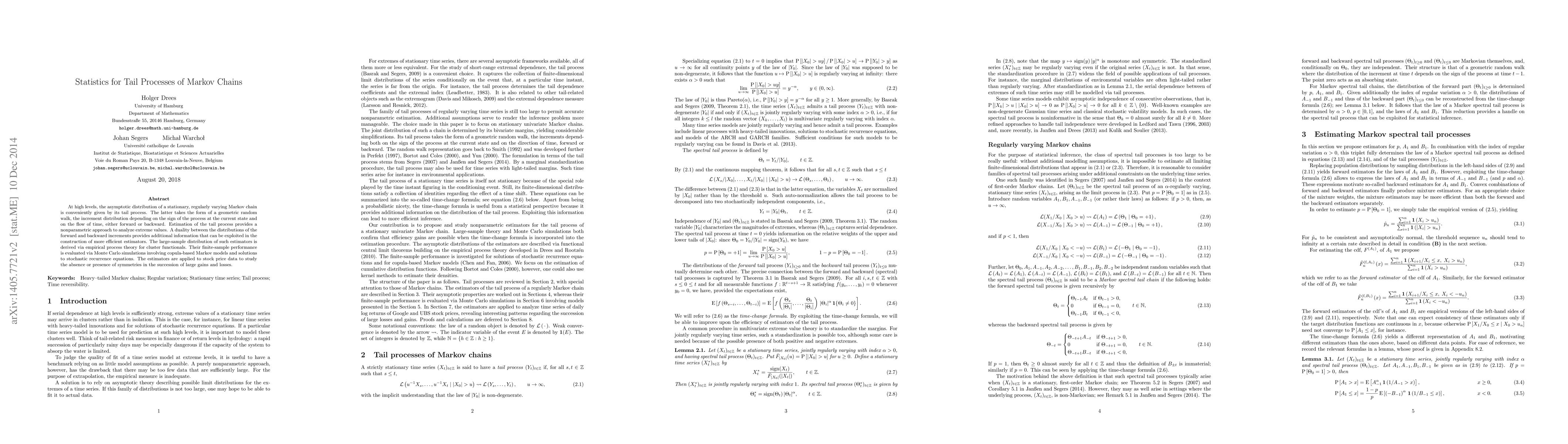

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConcentration Inequalities for Output Statistics of Quantum Markov Processes

Juan P. Garrahan, Federico Girotti, Mădălin Guţă

| Title | Authors | Year | Actions |

|---|

Comments (0)