Summary

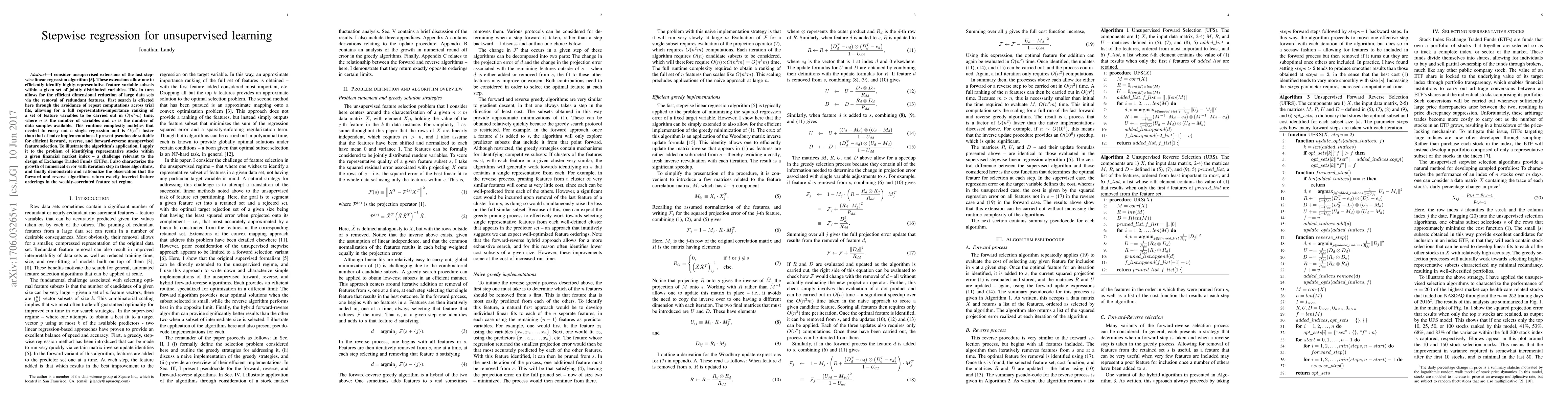

I consider unsupervised extensions of the fast stepwise linear regression algorithm \cite{efroymson1960multiple}. These extensions allow one to efficiently identify highly-representative feature variable subsets within a given set of jointly distributed variables. This in turn allows for the efficient dimensional reduction of large data sets via the removal of redundant features. Fast search is effected here through the avoidance of repeat computations across trial fits, allowing for a full representative-importance ranking of a set of feature variables to be carried out in $O(n^2 m)$ time, where $n$ is the number of variables and $m$ is the number of data samples available. This runtime complexity matches that needed to carry out a single regression and is $O(n^2)$ faster than that of naive implementations. I present pseudocode suitable for efficient forward, reverse, and forward-reverse unsupervised feature selection. To illustrate the algorithm's application, I apply it to the problem of identifying representative stocks within a given financial market index -- a challenge relevant to the design of Exchange Traded Funds (ETFs). I also characterize the growth of numerical error with iteration step in these algorithms, and finally demonstrate and rationalize the observation that the forward and reverse algorithms return exactly inverted feature orderings in the weakly-correlated feature set regime.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)