Summary

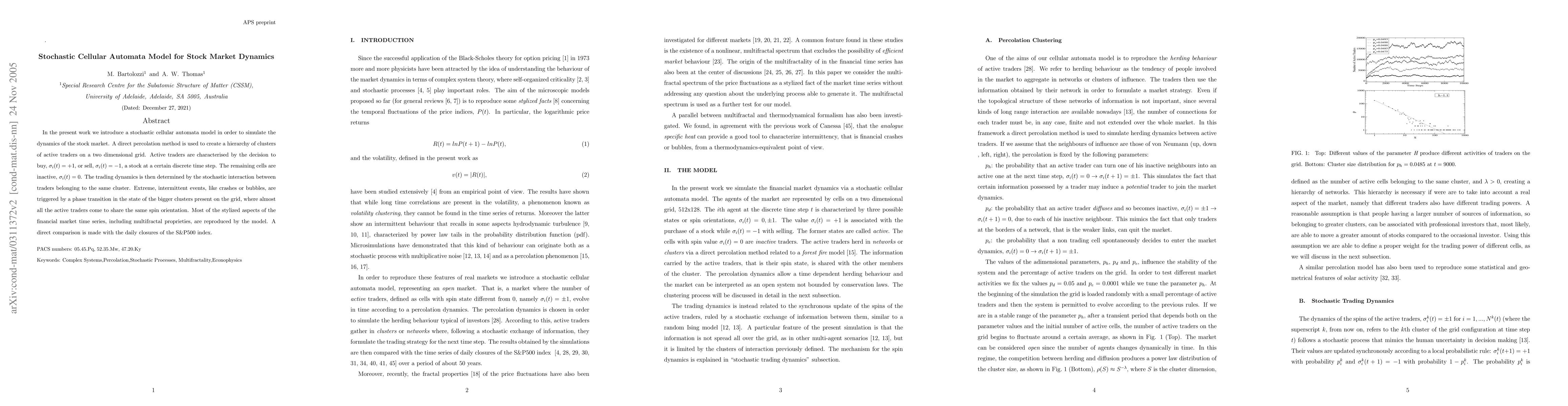

In the present work we introduce a stochastic cellular automata model in order to simulate the dynamics of the stock market. A direct percolation method is used to create a hierarchy of clusters of active traders on a two dimensional grid. Active traders are characterised by the decision to buy, (+1), or sell, (-1), a stock at a certain discrete time step. The remaining cells are inactive,(0). The trading dynamics is then determined by the stochastic interaction between traders belonging to the same cluster. Most of the stylized aspects of the financial market time series are reproduced by the model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStochastic optimization: Glauber dynamics versus stochastic cellular automata

Kazushi Kawamura, Akira Sakai, Bruno Hideki Fukushima-Kimura et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)