Summary

We consider a stochastic control problem for a class of nonlinear kernels. More precisely, our problem of interest consists in the optimisation, over a set of possibly non-dominated probability measures, of solutions of backward stochastic differential equations (BSDEs). Since BSDEs are nonlinear generalisations of the traditional (linear) expectations, this problem can be understood as stochastic control of a family of nonlinear expectations, or equivalently of nonlinear kernels. Our first main contribution is to prove a dynamic programming principle for this control problem in an abstract setting, which we then use to provide a semi-martingale characterisation of the value function. We next explore several applications of our results. We first obtain a wellposedness result for second order BSDEs (as introduced in [86]) which does not require any regularity assumption on the terminal condition and the generator. Then we prove a nonlinear optional decomposition in a robust setting, extending recent results of [71], which we then use to obtain a super-hedging duality in uncertain, incomplete and nonlinear financial markets. Finally, we relate, under additional regularity assumptions, the value function to a viscosity solution of an appropriate path-dependent partial differential equation (PPDE).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

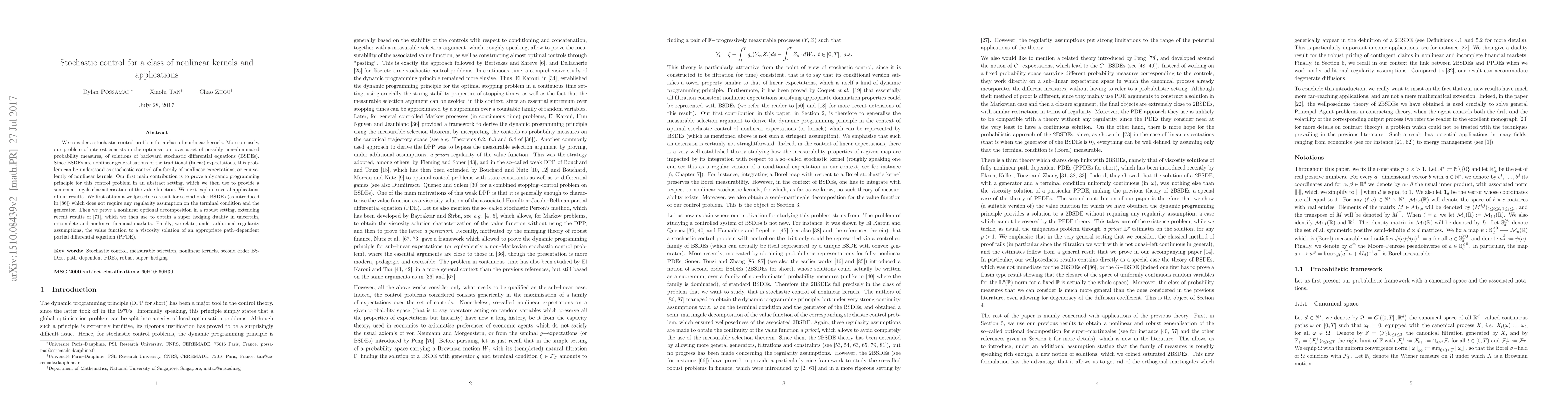

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA stochastic gradient method for a class of nonlinear PDE-constrained optimal control problems under uncertainty

Caroline Geiersbach, Teresa Scarinci

A Multilevel Approach for Stochastic Nonlinear Optimal Control

Ajay Jasra, Jeremy Heng, Adrian N. Bishop et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)