Summary

We study stochastic differential games of jump diffusions, where the players have access to inside information. Our approach is based on anticipative stochastic calculus, white noise, Hida-Malliavin calculus, forward integrals and the Donsker delta functional. We obtain a characterization of Nash equilibria of such games in terms of the corresponding Hamiltonians. This is used to study applications to insider games in finance, specifically optimal insider consumption and optimal insider portfolio under model uncertainty.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

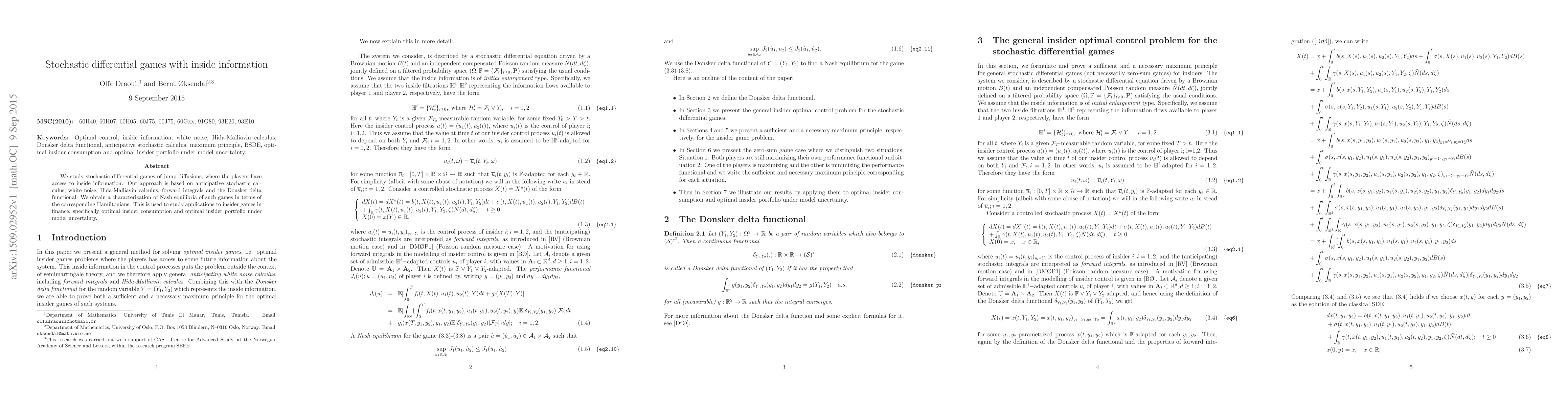

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)