Authors

Summary

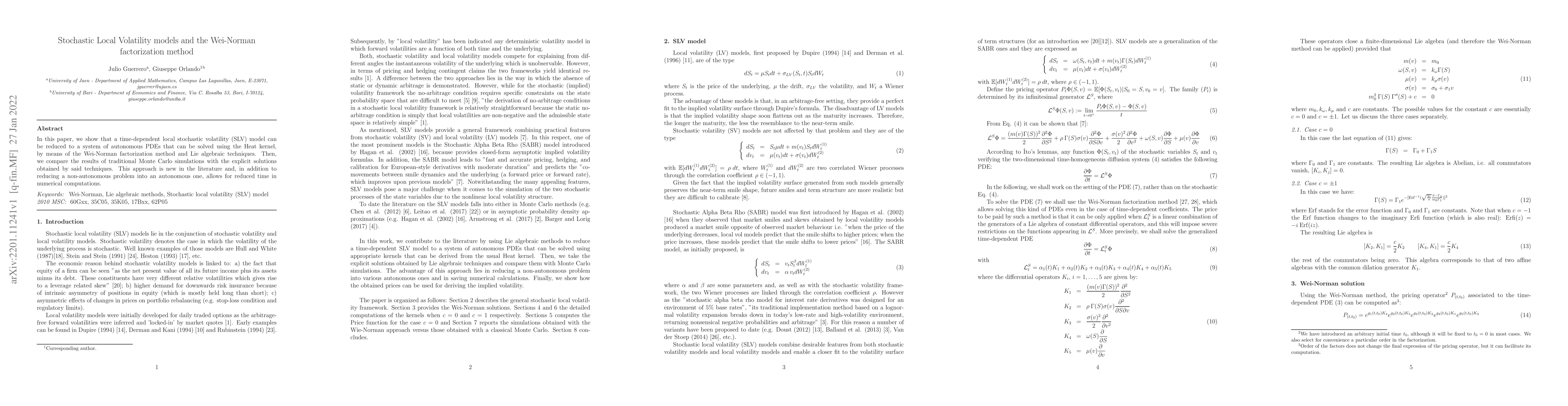

In this paper, we show that a time-dependent local stochastic volatility (SLV) model can be reduced to a system of autonomous PDEs that can be solved using the Heat kernel, by means of the Wei-Norman factorization method and Lie algebraic techniques. Then, we compare the results of traditional Monte Carlo simulations with the explicit solutions obtained by said techniques. This approach is new in the literature and, in addition to reducing a non-autonomous problem into an autonomous one, allows for reduced time in numerical computations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)