Summary

We present several models to describe the stochastic evolution of stocks that show some strong resistance at some level and generalize to this situation the evolution based upon geometric Brownian motion. If volatility and drift are related in a certain way we show that our model can be integrated in an exact way. The related problem of how to prize general securities that pay dividends at a continuous rate and earn a terminal payoff at maturity is solved via the martingale probability approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

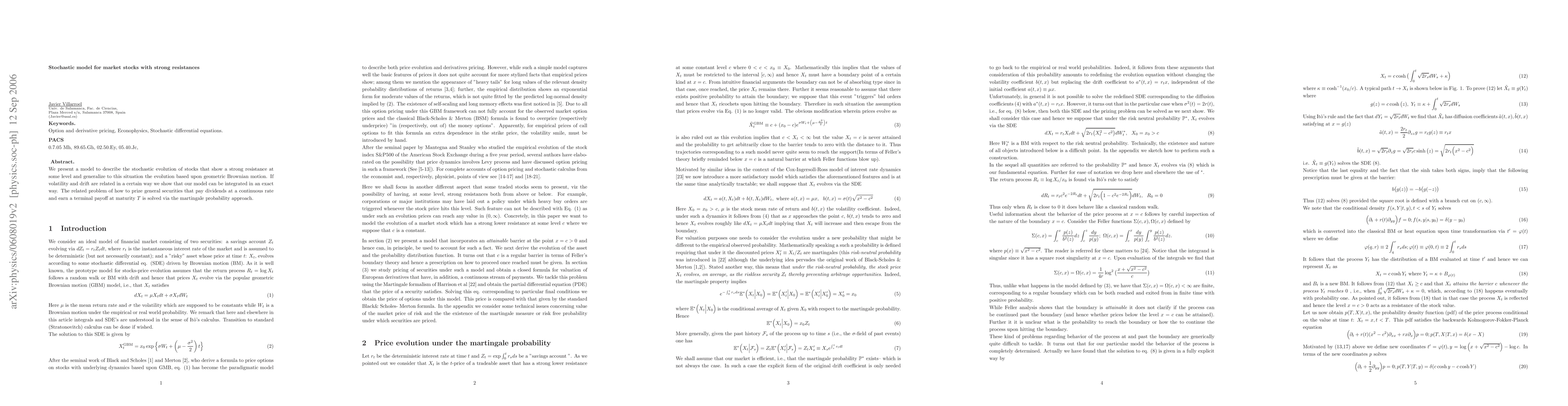

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)