Summary

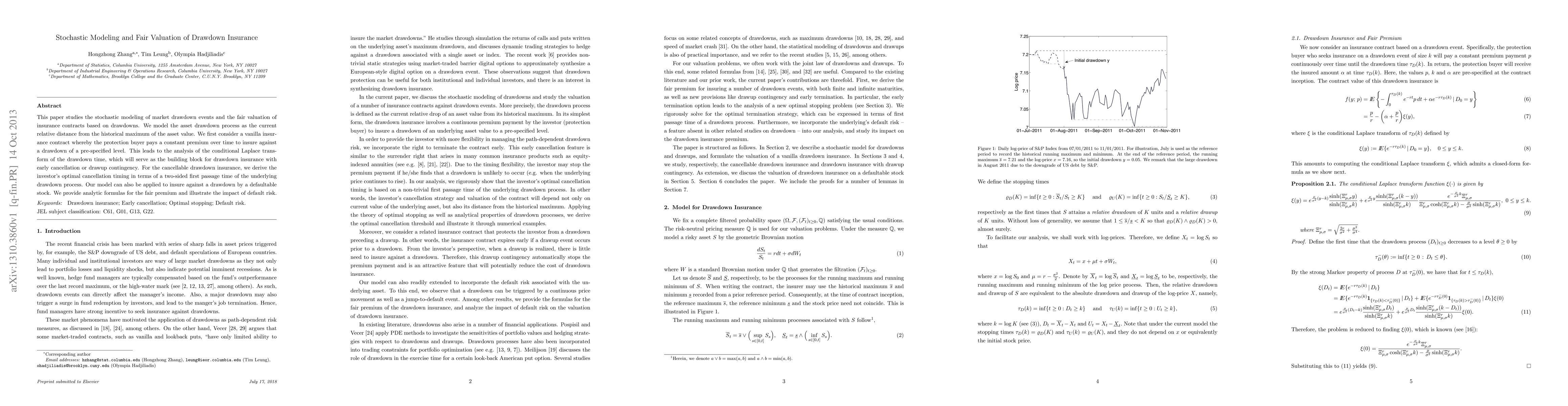

This paper studies the stochastic modeling of market drawdown events and the fair valuation of insurance contracts based on drawdowns. We model the asset drawdown process as the current relative distance from the historical maximum of the asset value. We first consider a vanilla insurance contract whereby the protection buyer pays a constant premium over time to insure against a drawdown of a pre-specified level. This leads to the analysis of the conditional Laplace transform of the drawdown time, which will serve as the building block for drawdown insurance with early cancellation or drawup contingency. For the cancellable drawdown insurance, we derive the investor's optimal cancellation timing in terms of a two-sided first passage time of the underlying drawdown process. Our model can also be applied to insure against a drawdown by a defaultable stock. We provide analytic formulas for the fair premium and illustrate the impact of default risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal consumption and life insurance under shortfall aversion and a drawdown constraint

Xiang Yu, Xun Li, Qinyi Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)