Summary

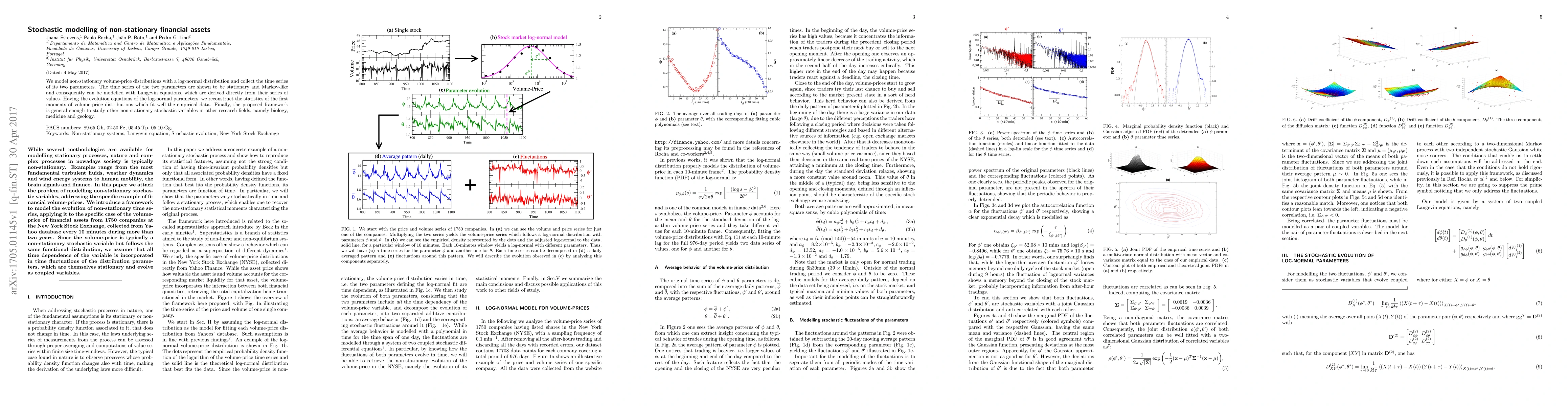

We model non-stationary volume-price distributions with a log-normal distribution and collect the time series of its two parameters. The time series of the two parameters are shown to be stationary and Markov-like and consequently can be modelled with Langevin equations, which are derived directly from their series of values. Having the evolution equations of the log-normal parameters, we reconstruct the statistics of the first moments of volume-price distributions which fit well the empirical data. Finally, the proposed framework is general enough to study other non-stationary stochastic variables in other research fields, namely biology, medicine and geology.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research models non-stationary volume-price distributions with a log-normal distribution, analyzing time series of its parameters φ and θ. These time series are shown to be stationary and Markov-like, allowing for modelling with Langevin equations derived directly from their series of values.

Key Results

- Time series of log-normal distribution parameters φ and θ are stationary and Markov-like.

- Langevin equations accurately model the evolution of φ and θ parameters.

- The proposed framework can be applied to other non-stationary stochastic variables in fields like biology, medicine, and geology.

Significance

This research provides a novel method to model and understand non-stationary financial assets, which can be extended to other fields, potentially aiding in risk assessment and predictive modeling.

Technical Contribution

The paper presents a stochastic modeling approach using Langevin equations for non-stationary financial time series, providing a method to reconstruct the statistics of volume-price distribution moments.

Novelty

The research introduces a novel approach to model non-stationary financial assets by decomposing the variables into daily patterns and fluctuations, modeling the latter with coupled Langevin equations, and extends the applicability of this method to other research fields.

Limitations

- The study assumes a log-normal distribution for volume-price data, which may not always hold true in all market conditions.

- Model performance might vary for different stock exchanges or asset classes due to varying trading patterns and market dynamics.

Future Work

- Investigate the applicability of this framework to other financial assets and markets.

- Explore the incorporation of additional factors (e.g., news events, macroeconomic indicators) that may influence non-stationary behavior in financial time series.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCopula-based deviation measure of cointegrated financial assets

Alexander Shulzhenko

Stock Embeddings: Learning Distributed Representations for Financial Assets

Rian Dolphin, Barry Smyth, Ruihai Dong

Non-stationary Financial Risk Factors and Macroeconomic Vulnerability for the UK

Tibor Szendrei, Katalin Varga

| Title | Authors | Year | Actions |

|---|

Comments (0)