Summary

We consider controlling the paths of a spectrally negative L\'evy process by two means: the subtraction of `taxes' when the process is at an all-time maximum, and the addition of `bailouts' which keep the value of the process above zero. We solve the corresponding stochastic optimal control problem of maximising the expected present value of the difference between taxes received and cost of bailouts given. Our class of taxation controls is larger than has been considered up till now in the literature and makes the problem truly two-dimensional rather than one-dimensional. Along the way, we define and characterise a large class of controlled L\'evy processes to which the optimal solution belongs, which extends a known result for perturbed Brownian motions to the case of a general L\'evy process with no positive jumps.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

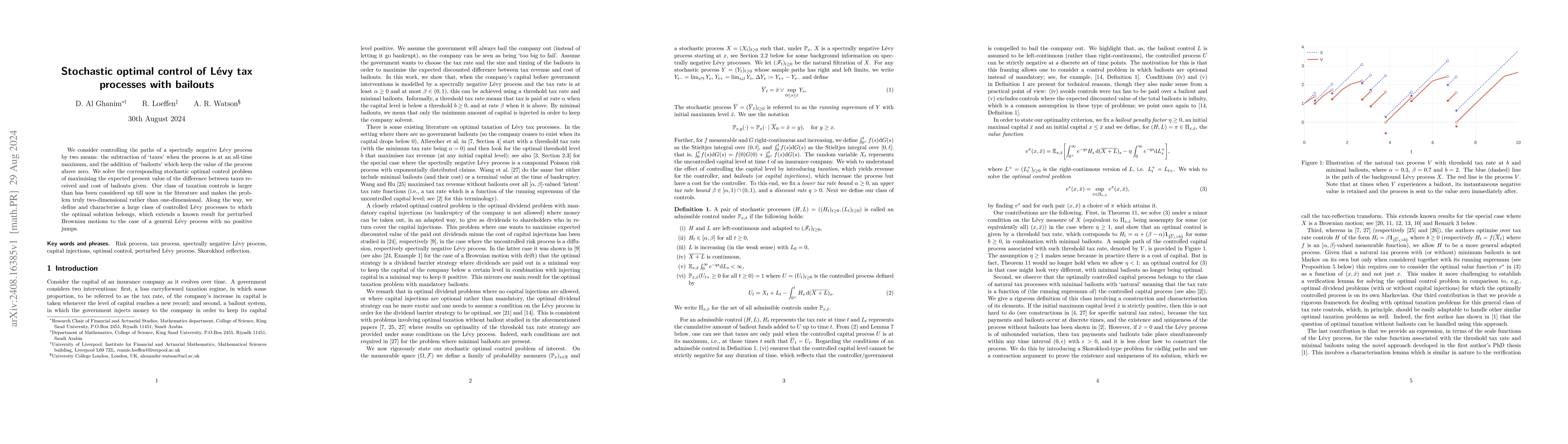

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFractional Backward Stochastic Partial Differential Equations with Applications to Stochastic Optimal Control of Partially Observed Systems driven by Lévy Processes

Yuyang Ye, Shanjian Tang, Yunzhang Li

No citations found for this paper.

Comments (0)