Authors

Summary

In this paper, we explore a new class of stochastic control problems characterized by specific control constraints. Specifically, the admissible controls are subject to the ratcheting constraint, meaning they must be non-decreasing over time and are thus self-path-dependent. This type of problems is common in various practical applications, such as optimal consumption problems in financial engineering and optimal dividend payout problems in actuarial science. Traditional stochastic control theory does not readily apply to these problems due to their unique self-path-dependent control feature. To tackle this challenge, we introduce a new class of Hamilton-Jacobi-Bellman (HJB) equations, which are variational inequalities concerning the derivative of a new spatial argument that represents the historical maximum control value. Under the standard Lipschitz continuity condition, we demonstrate that the value functions for these self-path-dependent control problems are the unique solutions to their corresponding HJB equations in the viscosity sense.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

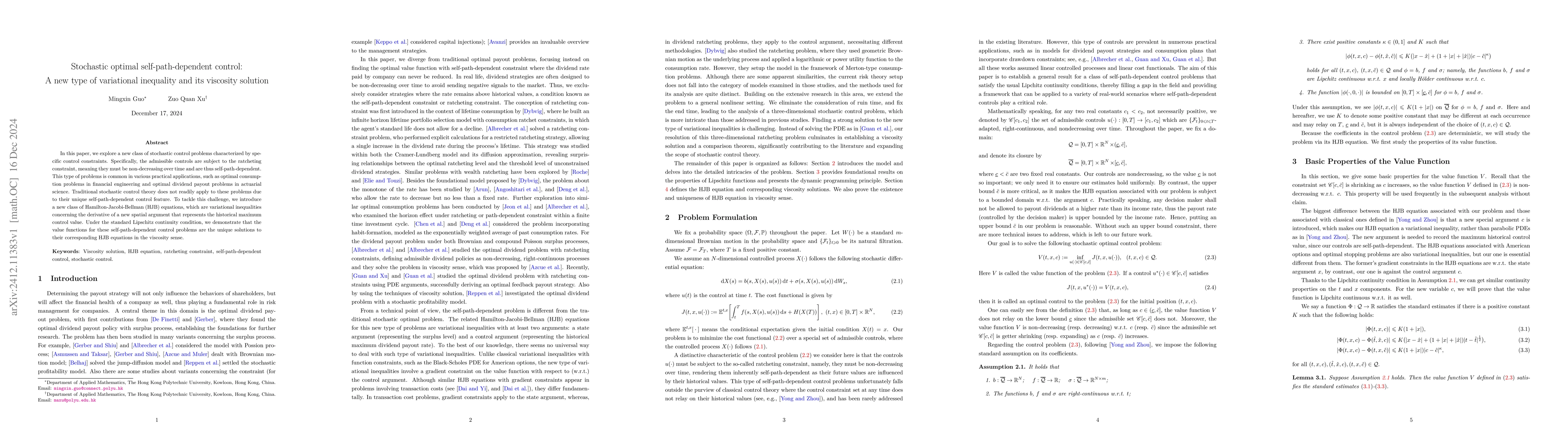

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)