Summary

We examine random variables in the power law/regularly varying class with stochastic tail exponent, the exponent $\alpha$ having its own distribution. We show the effect of stochasticity of $\alpha$ on the expectation and higher moments of the random variable. For instance, the moments of a right-tailed or right-asymmetric variable, when finite, increase with the variance of $\alpha$; those of a left-asymmetric one decreases. The same applies to conditional shortfall (CVar), or mean-excess functions. We prove the general case and examine the specific situation of lognormally distributed $\alpha \in [b,\infty), b>1$. The stochasticity of the exponent induces a significant bias in the estimation of the mean and higher moments in the presence of data uncertainty. This has consequences on sampling error as uncertainty about $\alpha$ translates into a higher expected mean. The bias is conserved under summation, even upon large enough a number of summands to warrant convergence to the stable distribution. We establish inequalities related to the asymmetry. We also consider the situation of capped power laws (i.e. with compact support), and apply it to the study of violence by Cirillo and Taleb (2016). We show that uncertainty concerning the historical data increases the true mean.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

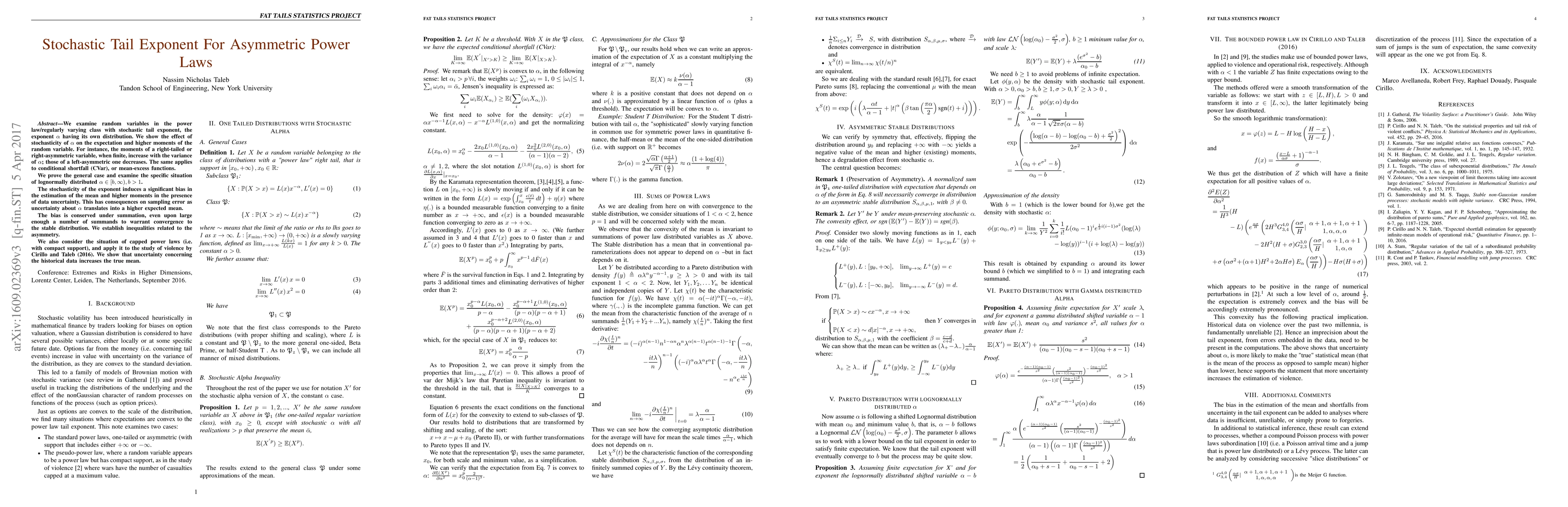

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)