Authors

Summary

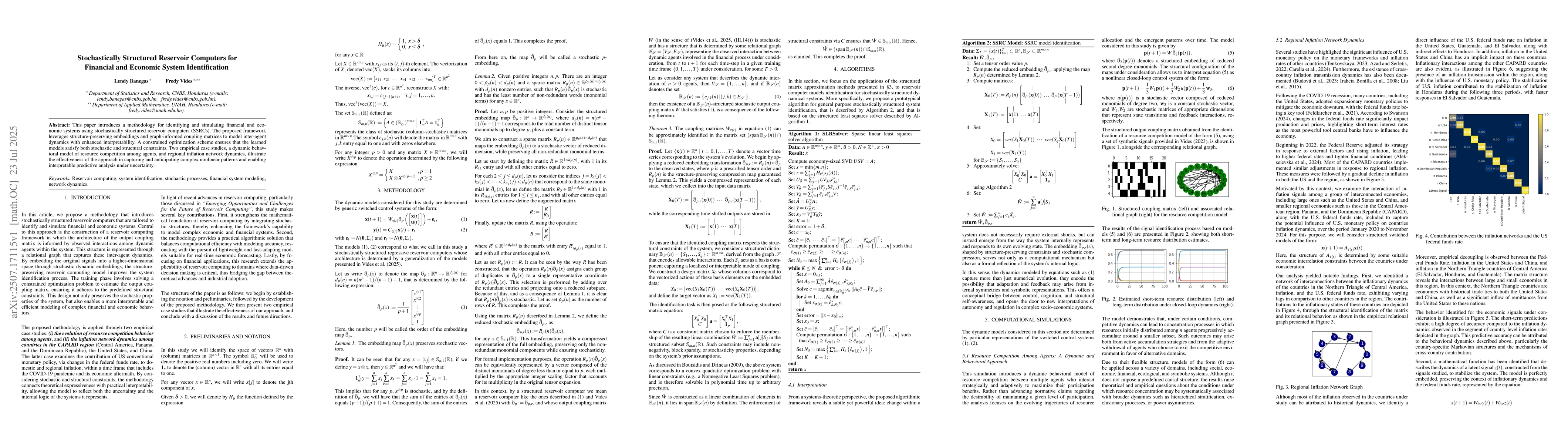

This paper introduces a methodology for identifying and simulating financial and economic systems using stochastically structured reservoir computers (SSRCs). The proposed framework leverages structure-preserving embeddings and graph-informed coupling matrices to model inter-agent dynamics with enhanced interpretability. A constrained optimization scheme ensures that the learned models satisfy both stochastic and structural constraints. Two empirical case studies, a dynamic behavioral model of resource competition among agents, and regional inflation network dynamics, illustrate the effectiveness of the approach in capturing and anticipating complex nonlinear patterns and enabling interpretable predictive analysis under uncertainty.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic financial processes identification using sparse regressive reservoir computers

Idelfonso B. R. Nogueira, Fredy Vides, Lendy Banegas et al.

No citations found for this paper.

Comments (0)