Authors

Summary

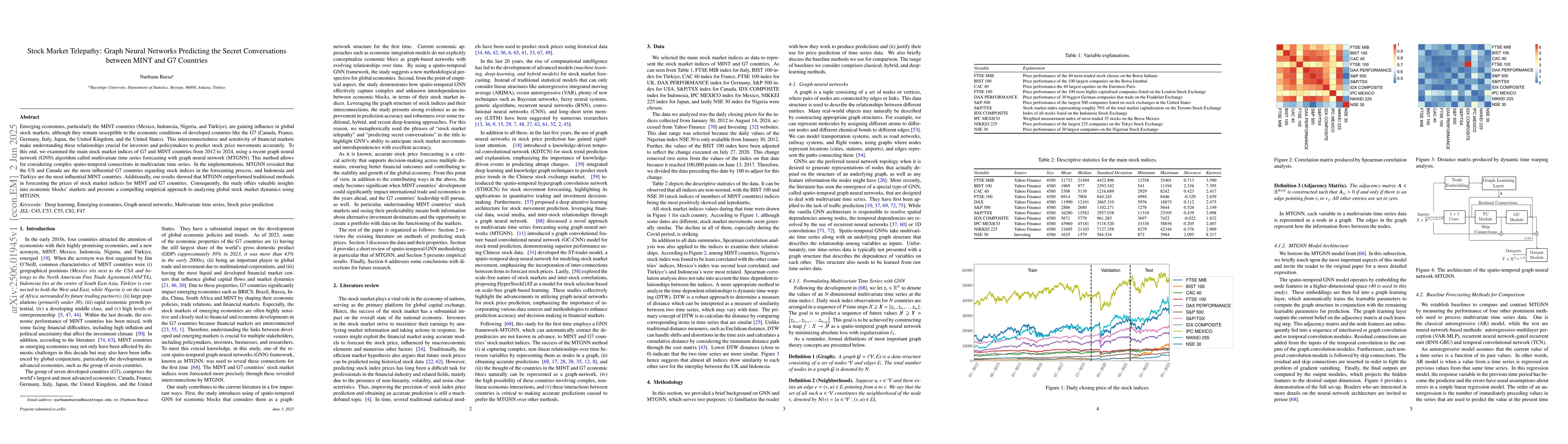

Emerging economies, particularly the MINT countries (Mexico, Indonesia, Nigeria, and T\"urkiye), are gaining influence in global stock markets, although they remain susceptible to the economic conditions of developed countries like the G7 (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States). This interconnectedness and sensitivity of financial markets make understanding these relationships crucial for investors and policymakers to predict stock price movements accurately. To this end, we examined the main stock market indices of G7 and MINT countries from 2012 to 2024, using a recent graph neural network (GNN) algorithm called multivariate time series forecasting with graph neural network (MTGNN). This method allows for considering complex spatio-temporal connections in multivariate time series. In the implementations, MTGNN revealed that the US and Canada are the most influential G7 countries regarding stock indices in the forecasting process, and Indonesia and T\"urkiye are the most influential MINT countries. Additionally, our results showed that MTGNN outperformed traditional methods in forecasting the prices of stock market indices for MINT and G7 countries. Consequently, the study offers valuable insights into economic blocks' markets and presents a compelling empirical approach to analyzing global stock market dynamics using MTGNN.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research utilized the multivariate time series forecasting with graph neural network (MTGNN) method to analyze the relationships between the stock market indices of G7 and MINT countries from 2012 to 2024, considering complex spatio-temporal connections in multivariate time series data.

Key Results

- The US and Canada were identified as the most influential G7 countries in stock index forecasting.

- Indonesia and Turkey were found to be the most influential MINT countries in stock index forecasting.

- MTGNN outperformed traditional forecasting methods in predicting stock market index prices for both MINT and G7 countries.

Significance

This research offers valuable insights into the dynamics of economic blocs' markets and presents a novel empirical approach using MTGNN to analyze global stock market relationships, which is crucial for investors and policymakers.

Technical Contribution

The implementation and application of the MTGNN algorithm for multivariate time series forecasting in the context of international stock market relationships.

Novelty

This work distinguishes itself by employing the MTGNN method to uncover complex spatio-temporal connections in stock market indices of both developed (G7) and emerging (MINT) economies, outperforming traditional forecasting methods.

Limitations

- The study focused on a specific time frame (2012-2024) and might not capture long-term or short-term trends outside this period.

- The findings are based on historical data and may not account for unforeseen geopolitical or economic events impacting future market dynamics.

Future Work

- Investigating the performance of MTGNN with more recent data to validate and update the findings.

- Exploring the applicability of MTGNN to other financial markets or asset classes beyond stock market indices.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)