Summary

A new method, based on the original theory of conservation of sum of kinetic and potential energy defined for prices is proposed and applied on Dow Jones Industrials Average (DJIA). The general trends averaged over months or years gave a roughly conserved total energy, with three different potential energies, i.e. positive definite quadratic, negative definite quadratic and linear potential energy for exponential rises (and falls), sinusoidal oscillations and parabolic trajectories, respectively. Corresponding expressions for force (impact) are also given. Keywords:

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

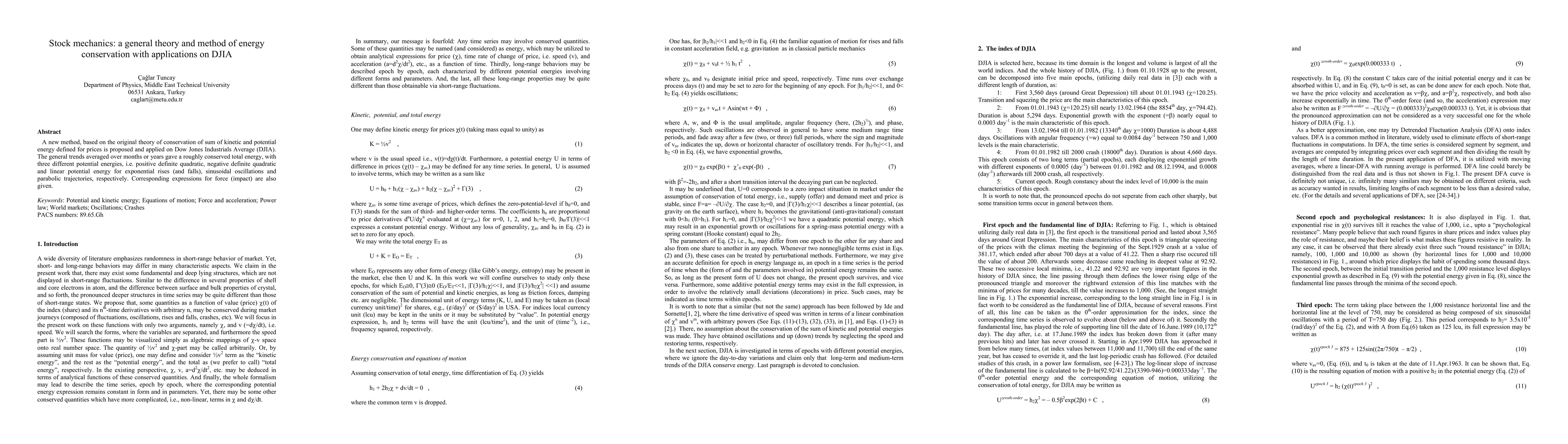

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)