Summary

We study an agent-based stock market model with heterogeneous agents and friction. Our model is based on that of Foellmer-Schweizer(1993): The process of a stock price in a discrete-time framework is determined by temporary equilibria via agents' excess demand functions, and the diffusion approximation approach is applied to characterize the continuous-time limit (as transaction intervals shorten) as a solution of the corresponding stochastic differential equation (SDE). In this paper we further make the assumption that some of the agents are bound by either short sale constraints or budget constraints. Then we show that the continuous-time process of the stock price can be derived from a certain SDE with oblique reflection. Moreover we find that the short sale (respectively, budget) constraint causes overpricing (respectively, underpricing).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

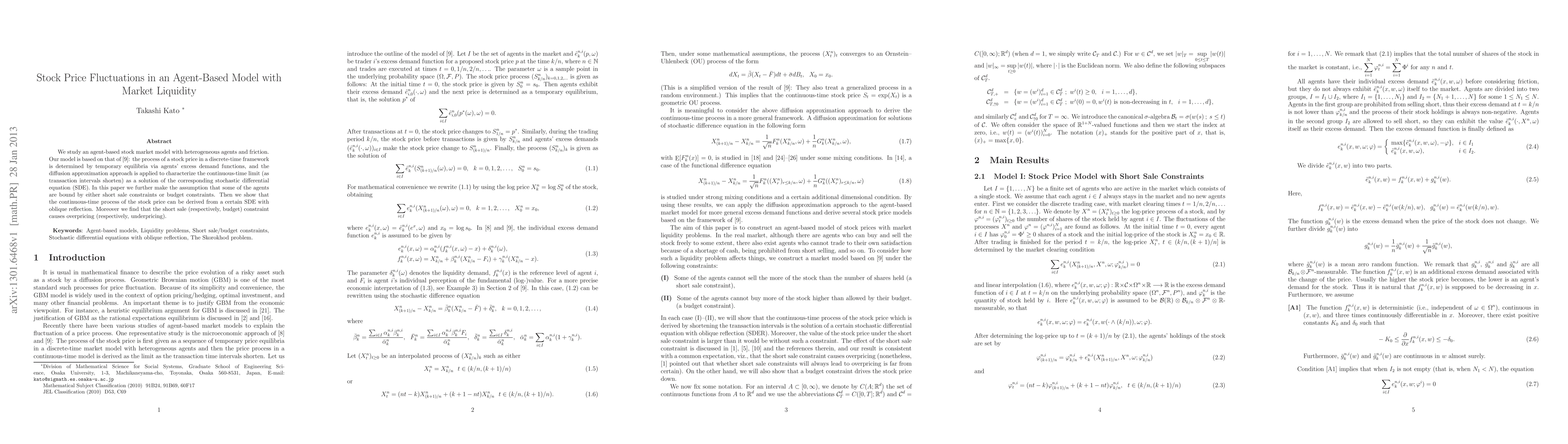

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice-mediated contagion with endogenous market liquidity

Zachary Feinstein, Zhiyu Cao

| Title | Authors | Year | Actions |

|---|

Comments (0)