Summary

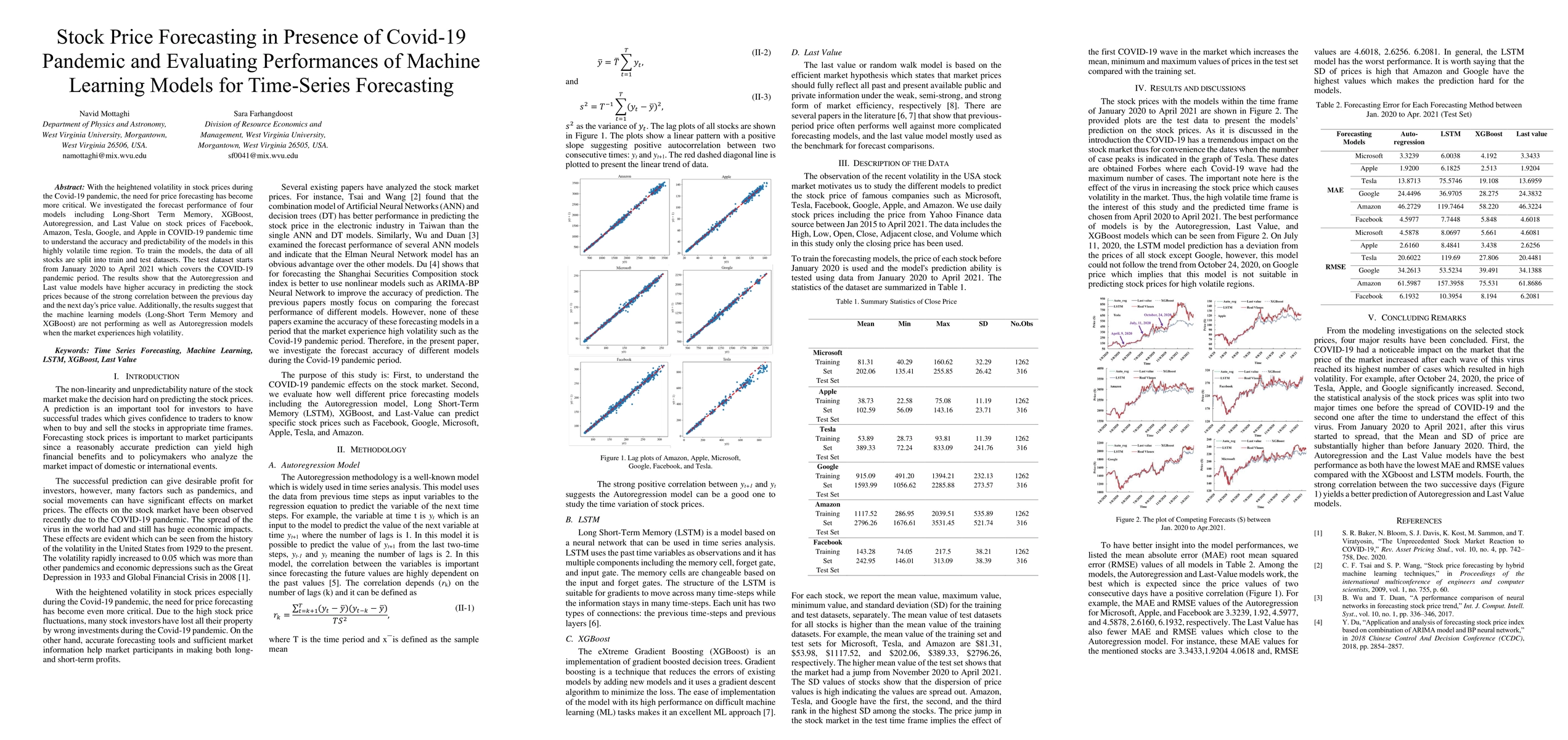

With the heightened volatility in stock prices during the Covid-19 pandemic, the need for price forecasting has become more critical. We investigated the forecast performance of four models including Long-Short Term Memory, XGBoost, Autoregression, and Last Value on stock prices of Facebook, Amazon, Tesla, Google, and Apple in COVID-19 pandemic time to understand the accuracy and predictability of the models in this highly volatile time region. To train the models, the data of all stocks are split into train and test datasets. The test dataset starts from January 2020 to April 2021 which covers the COVID-19 pandemic period. The results show that the Autoregression and Last value models have higher accuracy in predicting the stock prices because of the strong correlation between the previous day and the next day's price value. Additionally, the results suggest that the machine learning models (Long-Short Term Memory and XGBoost) are not performing as well as Autoregression models when the market experiences high volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting the Performance of US Stock Market Indices During COVID-19: RF vs LSTM

Ali Lashgari, Reza Nematirad, Amin Ahmadisharaf

Advancing Real-time Pandemic Forecasting Using Large Language Models: A COVID-19 Case Study

Yang Zhao, Yiran Chen, Xihong Lin et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)