Authors

Summary

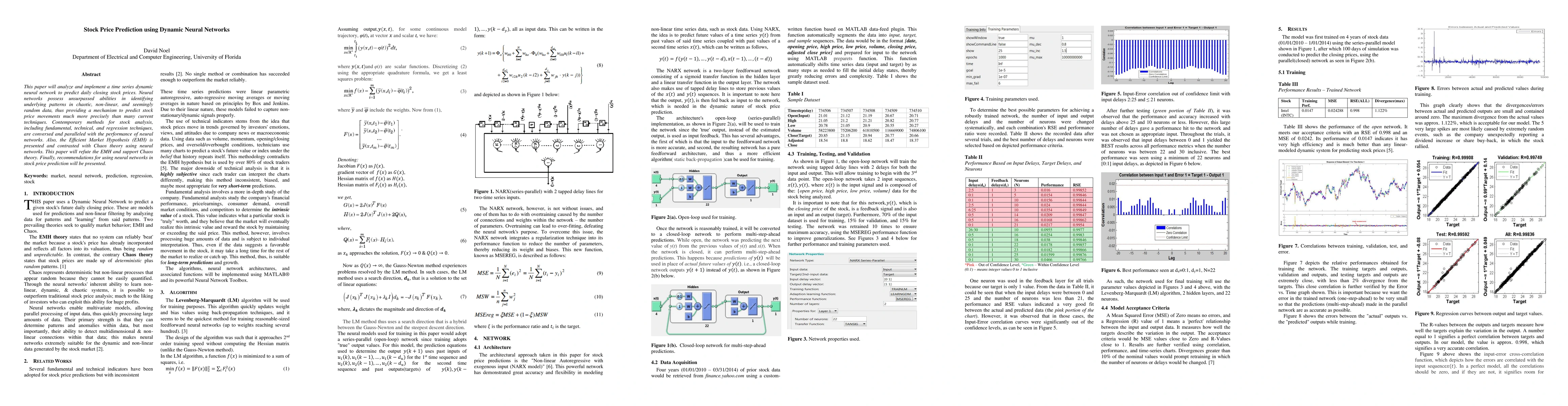

This paper will analyze and implement a time series dynamic neural network to predict daily closing stock prices. Neural networks possess unsurpassed abilities in identifying underlying patterns in chaotic, non-linear, and seemingly random data, thus providing a mechanism to predict stock price movements much more precisely than many current techniques. Contemporary methods for stock analysis, including fundamental, technical, and regression techniques, are conversed and paralleled with the performance of neural networks. Also, the Efficient Market Hypothesis (EMH) is presented and contrasted with Chaos theory using neural networks. This paper will refute the EMH and support Chaos theory. Finally, recommendations for using neural networks in stock price prediction will be presented.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStock Price Prediction using Multi-Faceted Information based on Deep Recurrent Neural Networks

Mohammad Manthouri, Lida Shahbandari, Elahe Moradi

No citations found for this paper.

Comments (0)