Summary

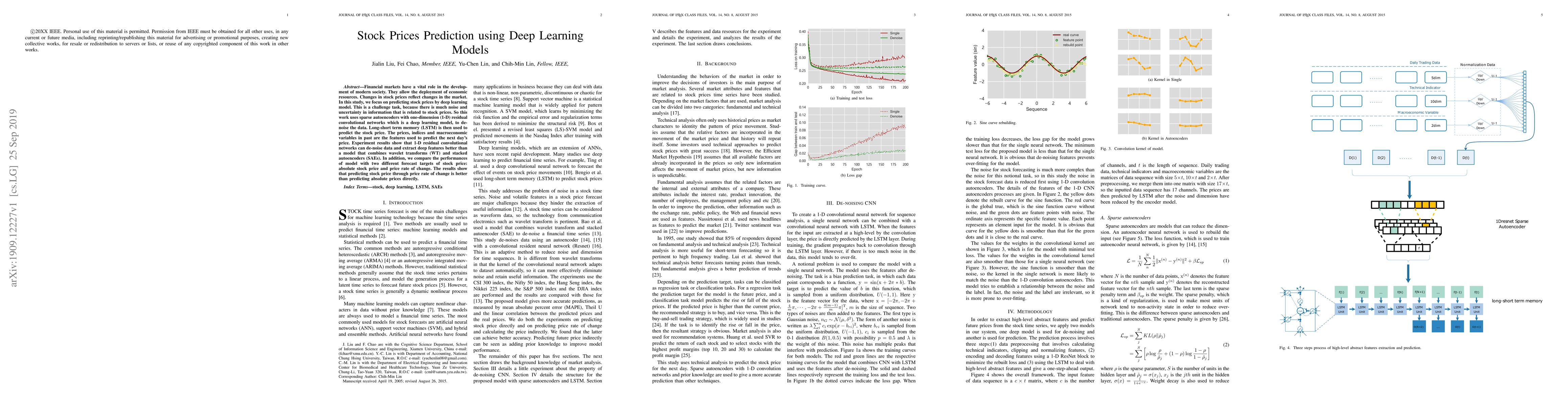

Financial markets have a vital role in the development of modern society. They allow the deployment of economic resources. Changes in stock prices reflect changes in the market. In this study, we focus on predicting stock prices by deep learning model. This is a challenge task, because there is much noise and uncertainty in information that is related to stock prices. So this work uses sparse autoencoders with one-dimension (1-D) residual convolutional networks which is a deep learning model, to de-noise the data. Long-short term memory (LSTM) is then used to predict the stock price. The prices, indices and macroeconomic variables in past are the features used to predict the next day's price. Experiment results show that 1-D residual convolutional networks can de-noise data and extract deep features better than a model that combines wavelet transforms (WT) and stacked autoencoders (SAEs). In addition, we compare the performances of model with two different forecast targets of stock price: absolute stock price and price rate of change. The results show that predicting stock price through price rate of change is better than predicting absolute prices directly.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)