Summary

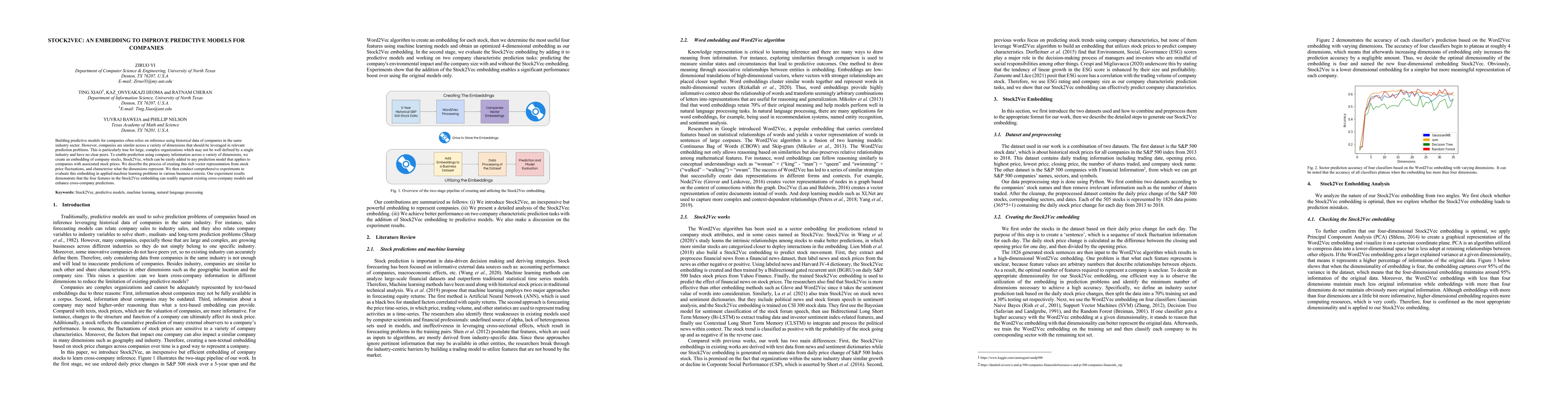

Building predictive models for companies often relies on inference using historical data of companies in the same industry sector. However, companies are similar across a variety of dimensions that should be leveraged in relevant prediction problems. This is particularly true for large, complex organizations which may not be well defined by a single industry and have no clear peers. To enable prediction using company information across a variety of dimensions, we create an embedding of company stocks, Stock2Vec, which can be easily added to any prediction model that applies to companies with associated stock prices. We describe the process of creating this rich vector representation from stock price fluctuations, and characterize what the dimensions represent. We then conduct comprehensive experiments to evaluate this embedding in applied machine learning problems in various business contexts. Our experiment results demonstrate that the four features in the Stock2Vec embedding can readily augment existing cross-company models and enhance cross-company predictions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)