Summary

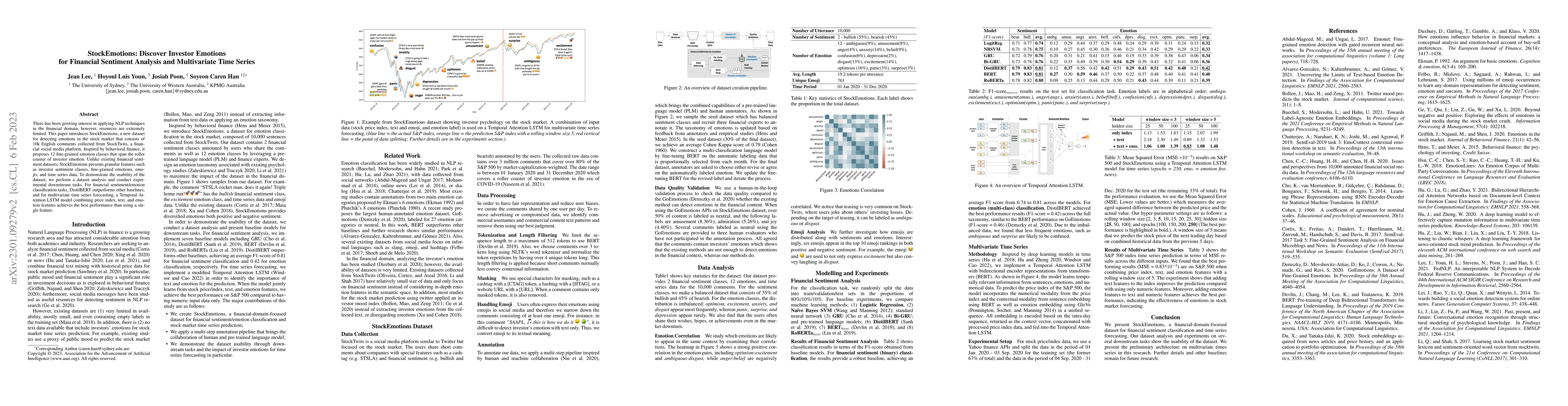

There has been growing interest in applying NLP techniques in the financial domain, however, resources are extremely limited. This paper introduces StockEmotions, a new dataset for detecting emotions in the stock market that consists of 10,000 English comments collected from StockTwits, a financial social media platform. Inspired by behavioral finance, it proposes 12 fine-grained emotion classes that span the roller coaster of investor emotion. Unlike existing financial sentiment datasets, StockEmotions presents granular features such as investor sentiment classes, fine-grained emotions, emojis, and time series data. To demonstrate the usability of the dataset, we perform a dataset analysis and conduct experimental downstream tasks. For financial sentiment/emotion classification tasks, DistilBERT outperforms other baselines, and for multivariate time series forecasting, a Temporal Attention LSTM model combining price index, text, and emotion features achieves the best performance than using a single feature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCausality between investor sentiment and the shares return on the Moroccan and Tunisian financial markets

Chniguir Mounira, Henchiri Jamel Eddine

| Title | Authors | Year | Actions |

|---|

Comments (0)