Summary

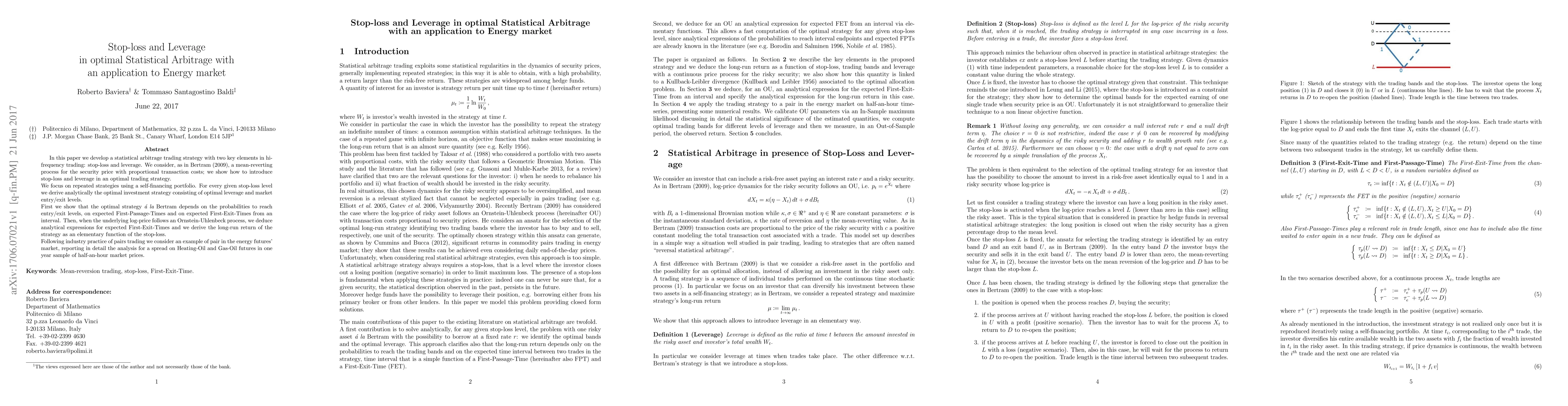

In this paper we develop a statistical arbitrage trading strategy with two key elements in hi-frequency trading: stop-loss and leverage. We consider, as in Bertram (2009), a mean-reverting process for the security price with proportional transaction costs; we show how to introduce stop-loss and leverage in an optimal trading strategy. We focus on repeated strategies using a self-financing portfolio. For every given stop-loss level we derive analytically the optimal investment strategy consisting of optimal leverage and market entry/exit levels. First we show that the optimal strategy a' la Bertram depends on the probabilities to reach entry/exit levels, on expected First-Passage-Times and on expected First-Exit-Times from an interval. Then, when the underlying log-price follows an Ornstein-Uhlenbeck process, we deduce analytical expressions for expected First-Exit-Times and we derive the long-run return of the strategy as an elementary function of the stop-loss. Following industry practice of pairs trading we consider an example of pair in the energy futures' market, reporting in detail the analysis for a spread on Heating-Oil and Gas-Oil futures in one year sample of half-an-hour market prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-market Optimal Energy Storage Arbitrage with Capacity Blocking for Emergency Services

Md Umar Hashmi, Stephen Hardy, Dirk Van Hertem et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)