Authors

Summary

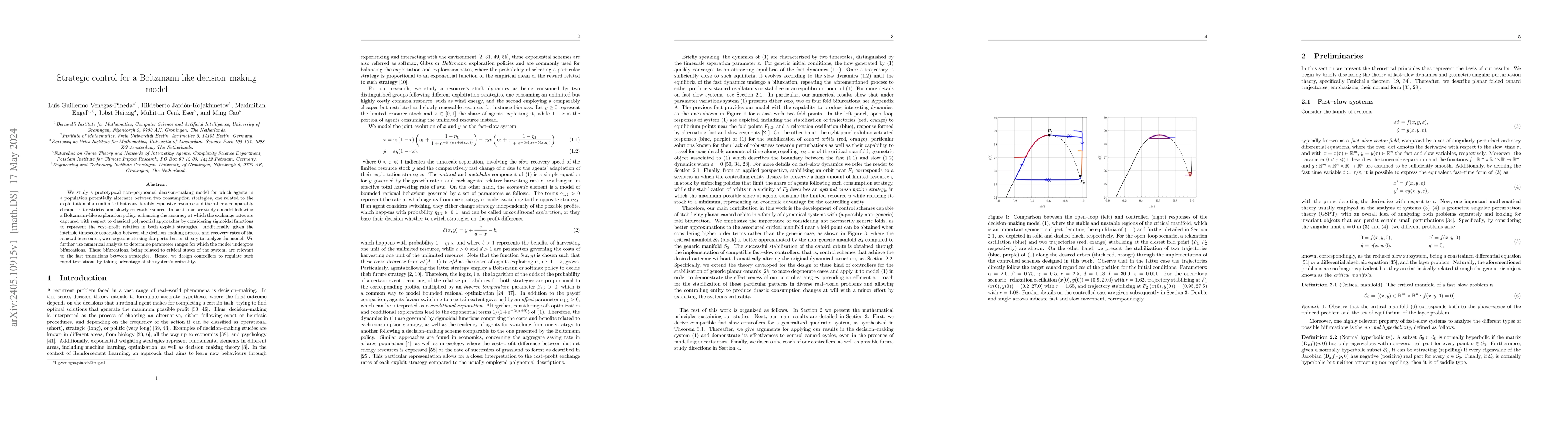

We study a prototypical non-polynomial decision-making model for which agents in a population potentially alternate between two consumption strategies, one related to the exploitation of an unlimited but considerably expensive resource and the other a comparably cheaper but restricted and slowly renewable source. In particular, we study a model following a Boltzmann-like exploration policy, enhancing the accuracy at which the exchange rates are captured with respect to classical polynomial approaches by considering sigmoidal functions to represent the cost-profit relation in both exploit strategies. Additionally, given the intrinsic timescale separation between the decision-making process and recovery rates of the renewable resource, we use geometric singular perturbation theory to analyze the model. We further use numerical analysis to determine parameter ranges for which the model undergoes bifurcations. These bifurcations, being related to critical states of the system, are relevant to the fast transitions between strategies. Hence, we design controllers to regulate such rapid transitions by taking advantage of the system's criticality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSTRIDE: A Tool-Assisted LLM Agent Framework for Strategic and Interactive Decision-Making

Chuanhao Li, Zhuoran Yang, Runhan Yang et al.

HLSMAC: A New StarCraft Multi-Agent Challenge for High-Level Strategic Decision-Making

Ye Yuan, Zijian Wu, Wenxin Li et al.

Optimal Decision Making Under Strategic Behavior

Bernhard Schölkopf, Adish Singla, Manuel Gomez-Rodriguez et al.

ToMPO: Training LLM Strategic Decision Making from a Multi-Agent Perspective

Yiwen Zhang, Yizhe Huang, Ziang Chen et al.

No citations found for this paper.

Comments (0)