Summary

Our aim is to design mechanisms that motivate all agents to reveal their predictions truthfully and promptly. For myopic agents, proper scoring rules induce truthfulness. However, as has been described in the literature, when agents take into account long-term effects of their actions, deception and reticence may appear. No simple rules exist to distinguish between the truthful and the untruthful situations, and a determination has been done in isolated cases only. This is of relevance to prediction markets, where the market value is a common prediction, and more generally in informal public prediction forums, such as stock-market estimates by analysts. We describe three mechanisms that are strategy-proof with non-myopic considerations, and show that one of them meets all our requirements from a mechanism in almost all prediction settings. We formulate rules to distinguish truthful from untruthful settings, and use them to extensively classify prediction settings with continuous outcomes. We show how our proposed mechanism restores prompt truthfulness where incumbent mechanisms fail, and offer guidelines to implementing it in a prediction market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

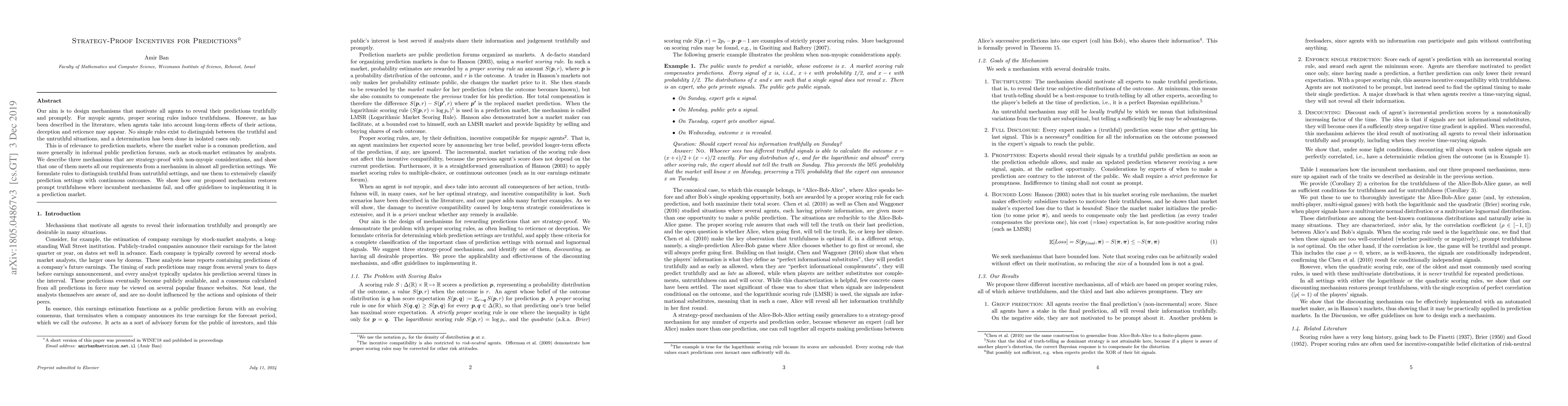

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)