Summary

There are two major streams of literature on the modeling of financial bubbles: the strict local martingale framework and the Johansen-Ledoit-Sornette (JLS) financial bubble model. Based on a class of models that embeds the JLS model and can exhibit strict local martingale behavior, we clarify the connection between these previously disconnected approaches. While the original JLS model is never a strict local martingale, there are relaxations which can be strict local martingales and which preserve the key assumption of a log-periodic power law for the hazard rate of the time of the crash. We then study the optimal investment problem for an investor with constant relative risk aversion in this model. We show that for positive instantaneous expected returns, investors with relative risk aversion above one always ride the bubble.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

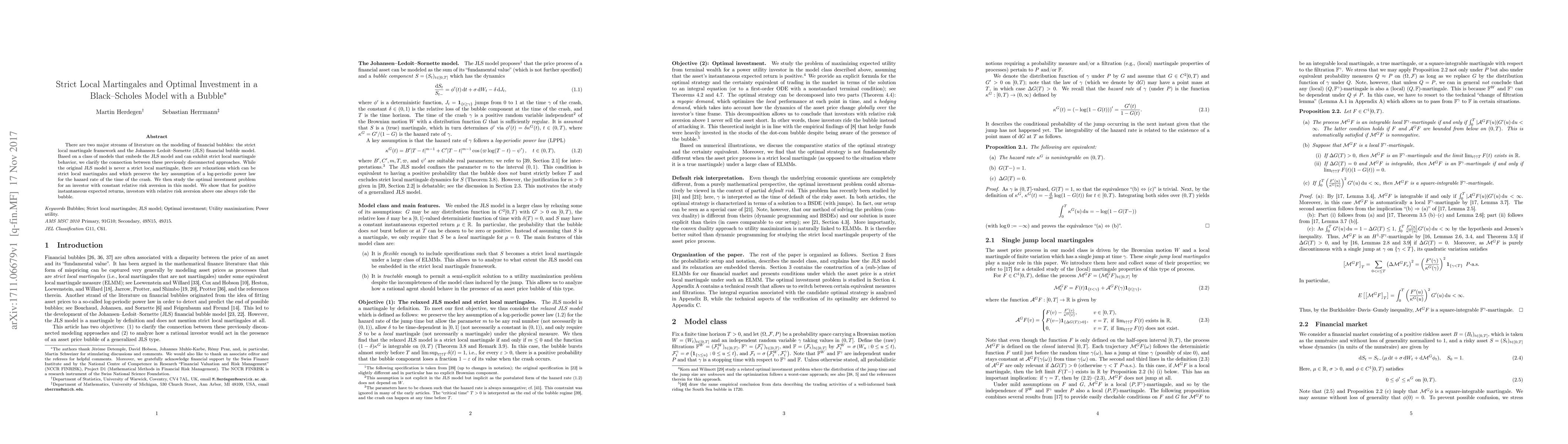

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)