Summary

Cox-Ingersoll-Ross (CIR) processes are widely used in financial modeling such as in the Heston model for the approximative pricing of financial derivatives. Moreover, CIR processes are mathematically interesting due to the irregular square root function in the diffusion coefficient. In the literature, positive strong convergence rates for numerical approximations of CIR processes have been established in the case of an inaccessible boundary point. Since calibrations of the Heston model frequently result in parameters such that the boundary is accessible, we focus on this interesting case. Our main result shows for every $p \in (0, \infty)$ that the drift-implicit square-root Euler approximations proposed in Alfonsi (2005) converge in the strong $L^p$-distance with a positive rate for half of the parameter regime in which the boundary point is accessible. A key step in our proof is temporal regularity of Bessel processes. More precisely, we prove for every $p \in (0, \infty)$ that Bessel processes are temporally $1/2$-H\"older continuous in $L^p$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

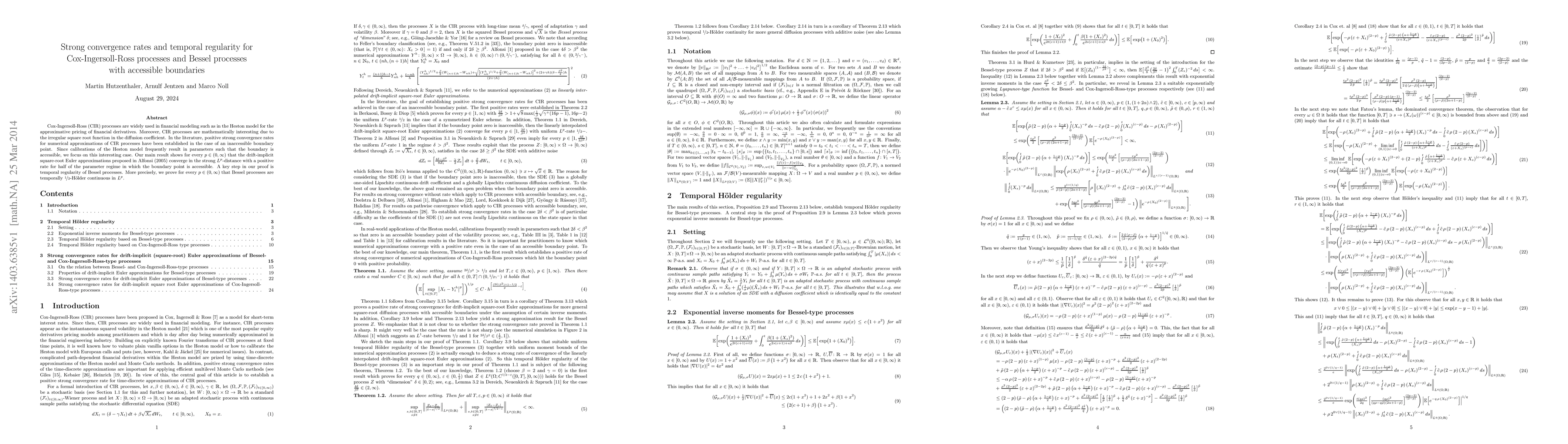

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDriven by Brownian motion Cox-Ingersoll-Ross and squared Bessel processes: interaction and phase transition

Yuliya Mishura, Kostiantyn Ralchenko, Svitlana Kushnirenko

| Title | Authors | Year | Actions |

|---|

Comments (0)