Summary

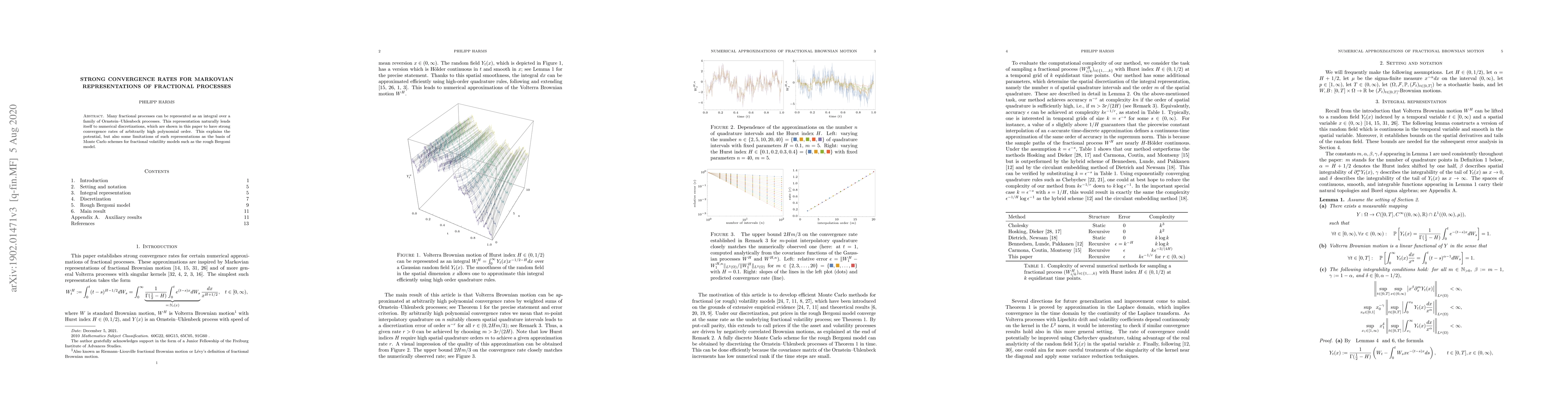

Many fractional processes can be represented as an integral over a family of Ornstein-Uhlenbeck processes. This representation naturally lends itself to numerical discretizations, which are shown in this paper to have strong convergence rates of arbitrarily high polynomial order. This explains the potential, but also some limitations of such representations as the basis of Monte Carlo schemes for fractional volatility models such as the rough Bergomi model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)