Summary

This paper generalizes results concerning strong convexity of two-stage mean-risk models with linear recourse to distortion risk measures. Introducing the concept of (restricted) partial strong convexity, we conduct an in-depth analysis of the expected excess functional with respect to the decision variable and the threshold parameter. These results allow to derive sufficient conditions for strong convexity of models building on the conditional value-at-risk due to its variational representation. Via Kusuoka representation these carry over to comonotonic and distortion risk measures, where we obtain verifiable conditions in terms of the distortion function. For stochastic optimisation models, we point out implications for quantitative stability with respect to perturbations of the underlying probability measure. Recent work in \cite{Ba14} and \cite{WaXi17} also gives testimony to the importance of strong convexity for the convergence rates of modern stochastic subgradient descent algorithms and in the setting of machine learning.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

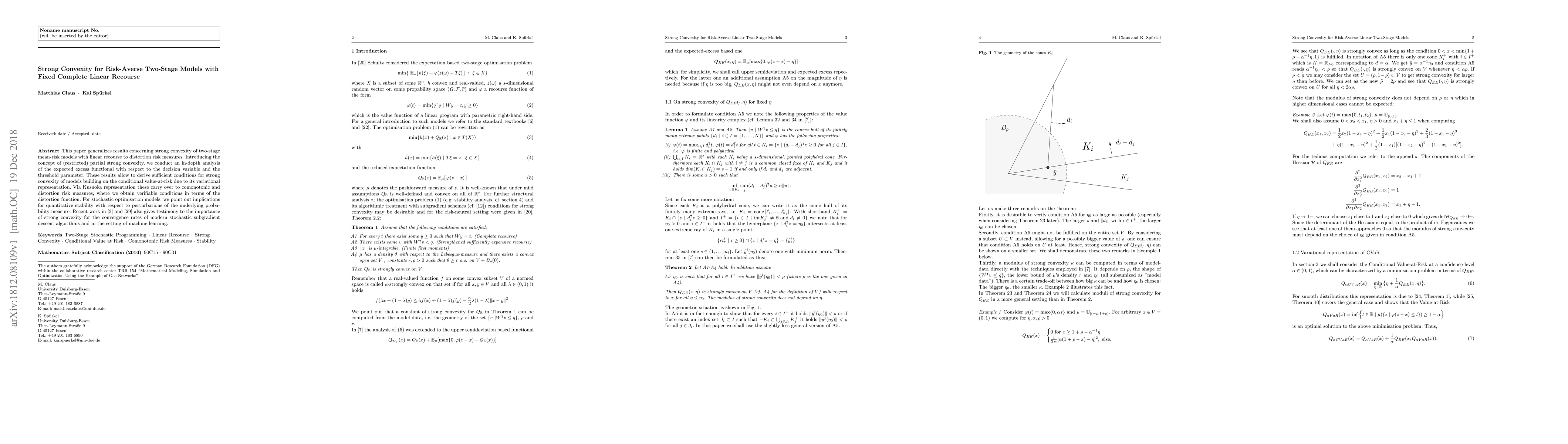

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)