Summary

Bitcoin, the first peer-to-peer electronic cash system, opened the door to permissionless, private, and trustless transactions. Attempts to repurpose Bitcoin's underlying blockchain technology have run up against fundamental limitations to privacy, faithful execution, and transaction finality. We introduce \emph{Strong Federations}: publicly verifiable, Byzantine-robust transaction networks that facilitate movement of any asset between disparate markets, without requiring third-party trust. \emph{Strong Federations} enable commercial privacy, with support for transactions where asset types and amounts are opaque, while remaining publicly verifiable. As in Bitcoin, execution fidelity is cryptographically enforced; however, \emph{Strong Federations} significantly lower capital requirements for market participants by reducing transaction latency and improving interoperability. To show how this innovative solution can be applied today, we describe \emph{\liquid}: the first implementation of \emph{Strong Federations} deployed in a Financial Market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

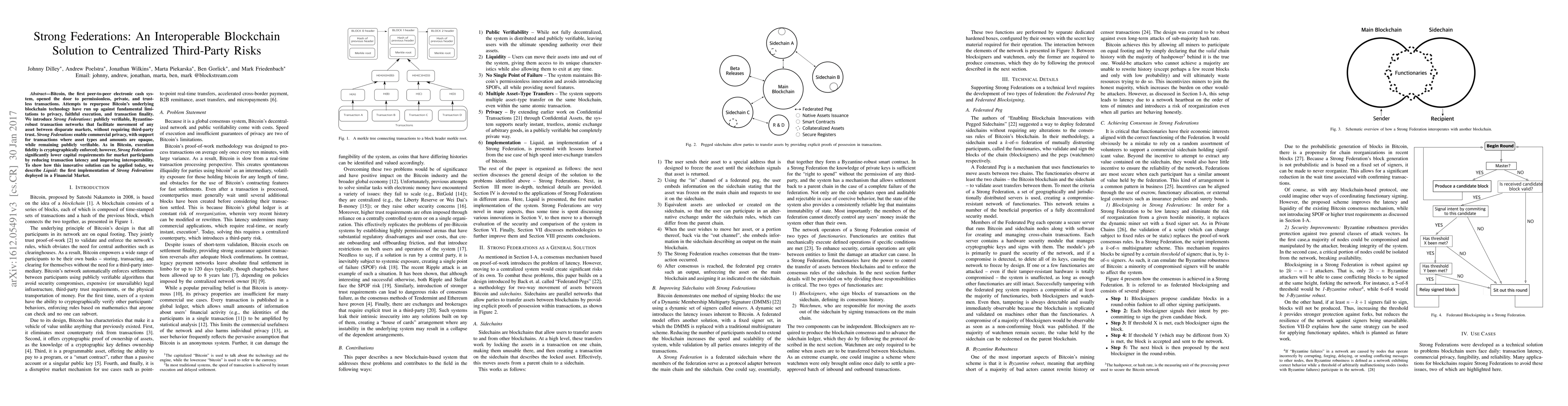

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBlockchain-based Transparency Framework for Privacy Preserving Third-party Services

Chao Li, Runhua Xu, James Joshi

Decentralised Identity Federations using Blockchain

Md. Nazmus Sakib, Mirza Kamrul Bashar Shuhan, Md Sadek Ferdous et al.

Blockchain-Enhanced Framework for Secure Third-Party Vendor Risk Management and Vigilant Security Controls

Lavanya Elluri, Deepti Gupta, Avi Jain et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)