Authors

Summary

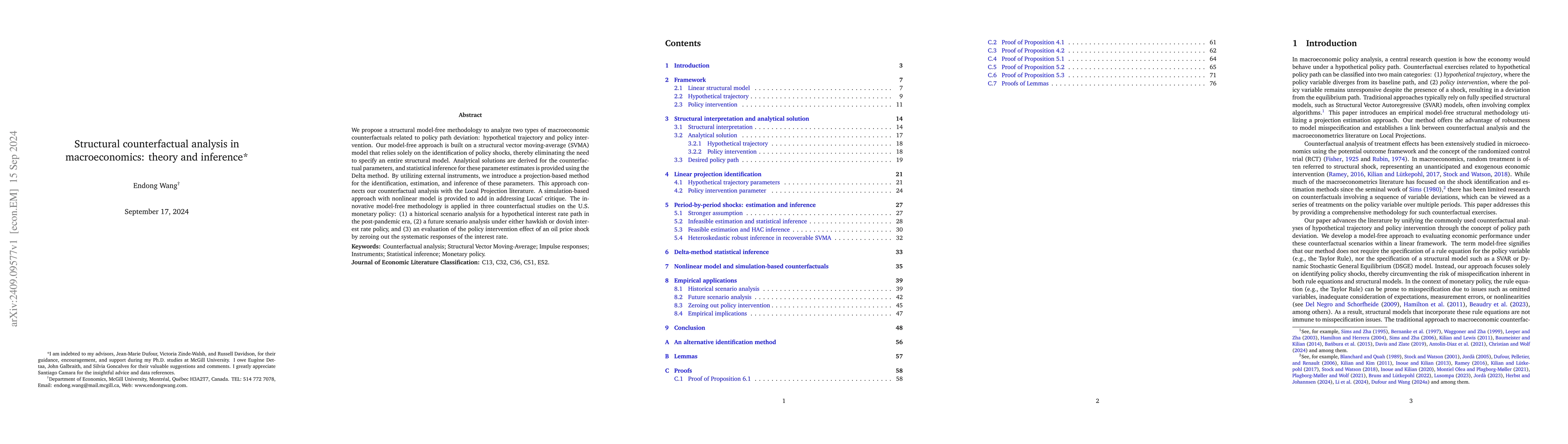

We propose a structural model-free methodology to analyze two types of macroeconomic counterfactuals related to policy path deviation: hypothetical trajectory and policy intervention. Our model-free approach is built on a structural vector moving-average (SVMA) model that relies solely on the identification of policy shocks, thereby eliminating the need to specify an entire structural model. Analytical solutions are derived for the counterfactual parameters, and statistical inference for these parameter estimates is provided using the Delta method. By utilizing external instruments, we introduce a projection-based method for the identification, estimation, and inference of these parameters. This approach connects our counterfactual analysis with the Local Projection literature. A simulation-based approach with nonlinear model is provided to add in addressing Lucas' critique. The innovative model-free methodology is applied in three counterfactual studies on the U.S. monetary policy: (1) a historical scenario analysis for a hypothetical interest rate path in the post-pandemic era, (2) a future scenario analysis under either hawkish or dovish interest rate policy, and (3) an evaluation of the policy intervention effect of an oil price shock by zeroing out the systematic responses of the interest rate.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper proposes a model-free methodology for analyzing macroeconomic counterfactuals related to policy path deviation, using a structural vector moving-average (SVMA) model and external instruments to identify, estimate, and infer parameters without specifying a full structural model.

Key Results

- Analytical solutions are derived for counterfactual parameters in hypothetical trajectory and policy intervention scenarios.

- Statistical inference for parameter estimates is provided using the Delta method and a projection-based method.

- The approach connects counterfactual analysis with the Local Projection literature and addresses Lucas' critique using a simulation-based approach with a nonlinear model.

- Three counterfactual studies on U.S. monetary policy are conducted: a historical scenario analysis for a hypothetical interest rate path in the post-pandemic era, a future scenario analysis under either hawkish or dovish interest rate policy, and an evaluation of the policy intervention effect of an oil price shock.

Significance

This research contributes to macroeconomic analysis by providing a flexible, model-free methodology for assessing counterfactual scenarios, which can inform policy decisions and improve understanding of economic dynamics.

Technical Contribution

The paper develops a novel, model-free methodology for structural counterfactual analysis in macroeconomics, deriving analytical solutions and statistical inference for counterfactual parameters without relying on a full structural model.

Novelty

This research introduces a unique, flexible approach to macroeconomic counterfactual analysis that does not require a fully specified structural model, distinguishing it from previous work that often relies on complex, potentially misspecified models.

Limitations

- The method relies on the availability of suitable external instruments for identification and inference.

- The accuracy of results depends on the quality of impulse response estimates and the chosen instrumental variable.

- As with any econometric approach, the findings are subject to potential model misspecification and unmeasured variables.

Future Work

- Further research could explore the application of this methodology to other economic policy areas and countries.

- Investigating the robustness of the findings to different instrumental variables and estimation techniques would be valuable.

- Extending the approach to incorporate more complex economic models and additional macroeconomic variables could enhance its applicability.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)