Summary

The ex-ante evaluation of policies using structural econometric models is based on estimated parameters as a stand-in for the true parameters. This practice ignores uncertainty in the counterfactual policy predictions of the model. We develop a generic approach that deals with parametric uncertainty using uncertainty sets and frames model-informed policy-making as a decision problem under uncertainty. The seminal human capital investment model by Keane and Wolpin (1997) provides a well-known, influential, and empirically-grounded test case. We document considerable uncertainty in the models's policy predictions and highlight the resulting policy recommendations obtained from using different formal rules of decision-making under uncertainty.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

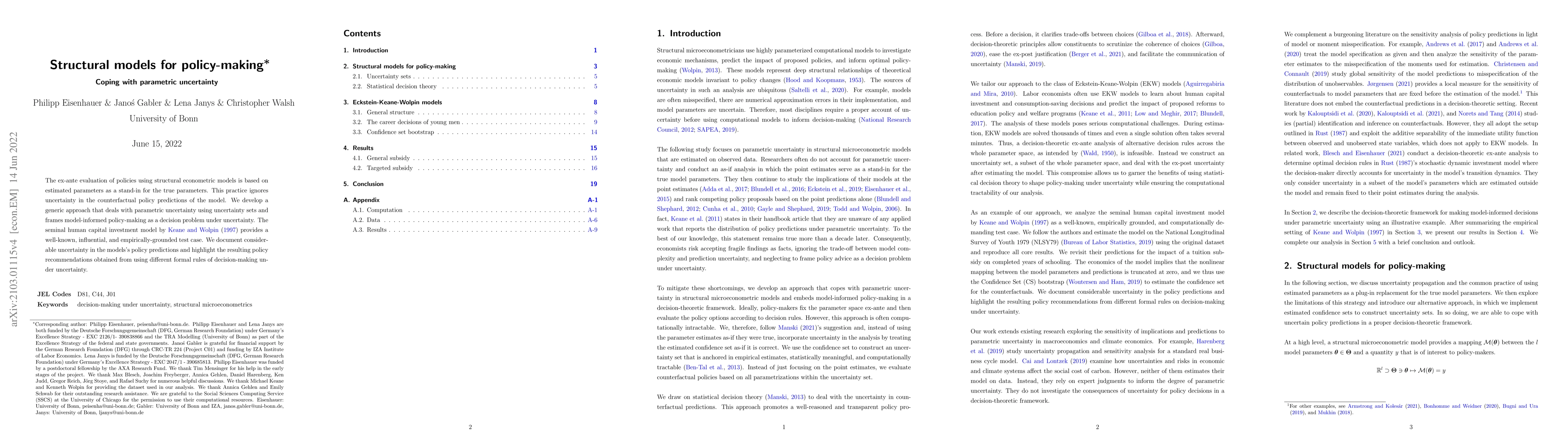

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUncertainty Quantification and Causal Considerations for Off-Policy Decision Making

Muhammad Faaiz Taufiq

| Title | Authors | Year | Actions |

|---|

Comments (0)