Summary

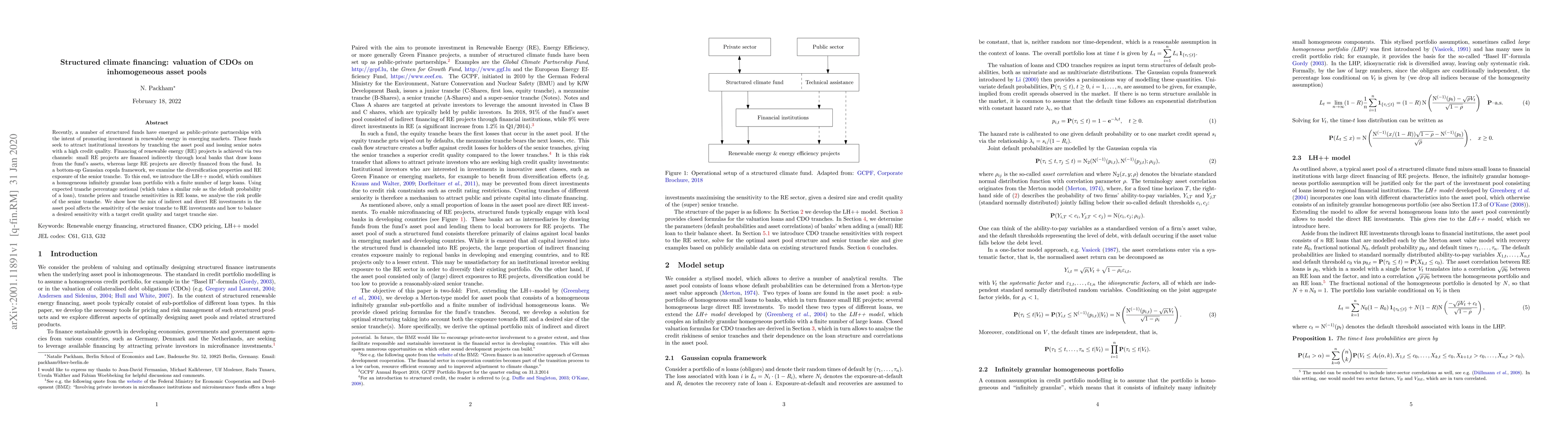

Recently, a number of structured funds have emerged as public-private partnerships with the intent of promoting investment in renewable energy in emerging markets. These funds seek to attract institutional investors by tranching the asset pool and issuing senior notes with a high credit quality. Financing of renewable energy (RE) projects is achieved via two channels: small RE projects are financed indirectly through local banks that draw loans from the fund's assets, whereas large RE projects are directly financed from the fund. In a bottom-up Gaussian copula framework, we examine the diversification properties and RE exposure of the senior tranche. To this end, we introduce the LH++ model, which combines a homogeneous infinitely granular loan portfolio with a finite number of large loans. Using expected tranche percentage notional (which takes a similar role as the default probability of a loan), tranche prices and tranche sensitivities in RE loans, we analyse the risk profile of the senior tranche. We show how the mix of indirect and direct RE investments in the asset pool affects the sensitivity of the senior tranche to RE investments and how to balance a desired sensitivity with a target credit quality and target tranche size.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersClimate Physical Risk Assessment in Asset Management

Michele Azzone, Davide Stocco, Matteo Ghesini et al.

Intergenerational Equitable Climate Change Mitigation: Negative Effects of Stochastic Interest Rates; Positive Effects of Financing

Christian P. Fries, Lennart Quante

| Title | Authors | Year | Actions |

|---|

Comments (0)