Summary

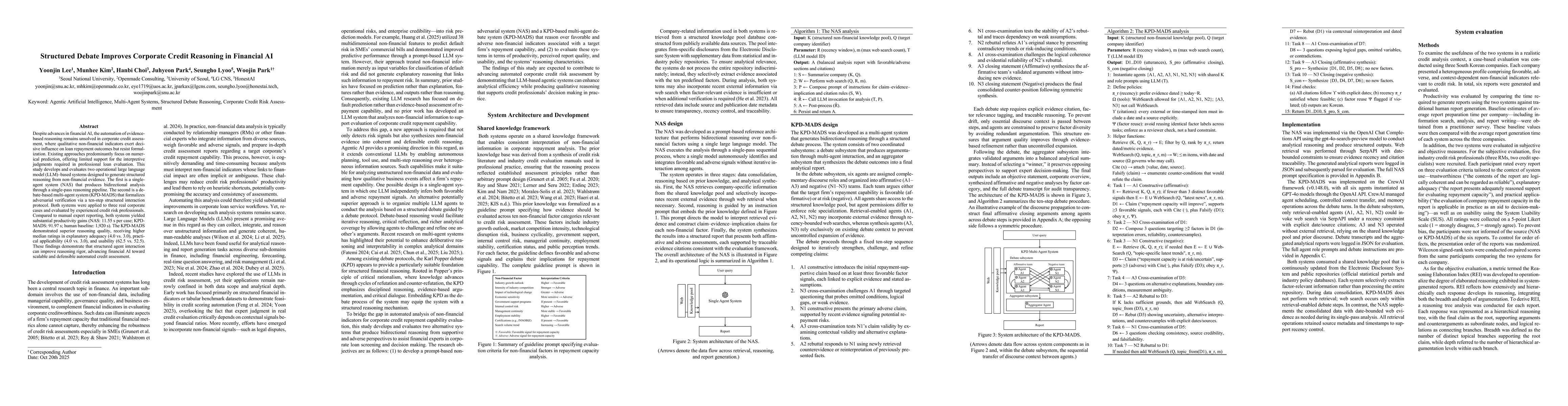

Despite advances in financial AI, the automation of evidence-based reasoning remains unresolved in corporate credit assessment, where qualitative non-financial indicators exert decisive influence on loan repayment outcomes yet resist formalization. Existing approaches focus predominantly on numerical prediction and provide limited support for the interpretive judgments required in professional loan evaluation. This study develops and evaluates two operational large language model (LLM)-based systems designed to generate structured reasoning from non-financial evidence. The first is a non-adversarial single-agent system (NAS) that produces bidirectional analysis through a single-pass reasoning pipeline. The second is a debate-based multi-agent system (KPD-MADS) that operationalizes adversarial verification through a ten-step structured interaction protocol grounded in Karl Popper's critical dialogue framework. Both systems were applied to three real corporate cases and evaluated by experienced credit risk professionals. Compared to manual expert reporting, both systems achieved substantial productivity gains (NAS: 11.55 s per case; KPD-MADS: 91.97 s; human baseline: 1920 s). The KPD-MADS demonstrated superior reasoning quality, receiving higher median ratings in explanatory adequacy (4.0 vs. 3.0), practical applicability (4.0 vs. 3.0), and usability (62.5 vs. 52.5). These findings show that structured multi-agent interaction can enhance reasoning rigor and interpretability in financial AI, advancing scalable and defensible automation in corporate credit assessment.

AI Key Findings

Generated Oct 25, 2025

Methodology

The study developed and evaluated two LLM-based systems: a non-adversarial single-agent system (NAS) and a debate-based multi-agent system (KPD-MADS) using structured interaction protocols. Both systems were tested on real corporate cases and assessed by credit risk professionals.

Key Results

- KPD-MADS demonstrated superior reasoning quality with higher median ratings in explanatory adequacy, practical applicability, and usability compared to NAS and human baseline

- NAS achieved productivity gains but lacked depth in analysis and failed to evaluate competing explanations

- KPD-MADS showed structured debate improved reasoning rigor and interpretability through adversarial verification

Significance

This research advances scalable and defensible automation in corporate credit assessment by demonstrating how structured multi-agent interaction can enhance financial AI reasoning quality, addressing critical gaps in qualitative non-financial credit evaluation

Technical Contribution

Formalizing reasoning as a structured argumentative process through Karl Popper's critical dialogue framework, enabling adversarial verification and procedural constraints for stable reasoning

Novelty

Introduces a structured debate protocol for financial AI that combines adversarial verification with procedural constraints, achieving defensible reasoning without task-specific fine-tuning through structured prompting alone

Limitations

- Evaluators were blind to latency differences during assessment

- NAS outputs often lacked evaluation of competing explanations and relied on unchallenged assumptions

Future Work

- Systematically examine debate protocol design by varying procedural parameters

- Explore architectural enhancements through agent specialization and domain expertise integration

Paper Details

PDF Preview

Similar Papers

Found 4 papersContrastive Pre-training for Imbalanced Corporate Credit Ratings

Wenfang Xue, Bojing Feng

GRPO-$λ$: Credit Assignment improves LLM Reasoning

Yufei Cui, Sarath Chandar, Boxing Chen et al.

Comments (0)