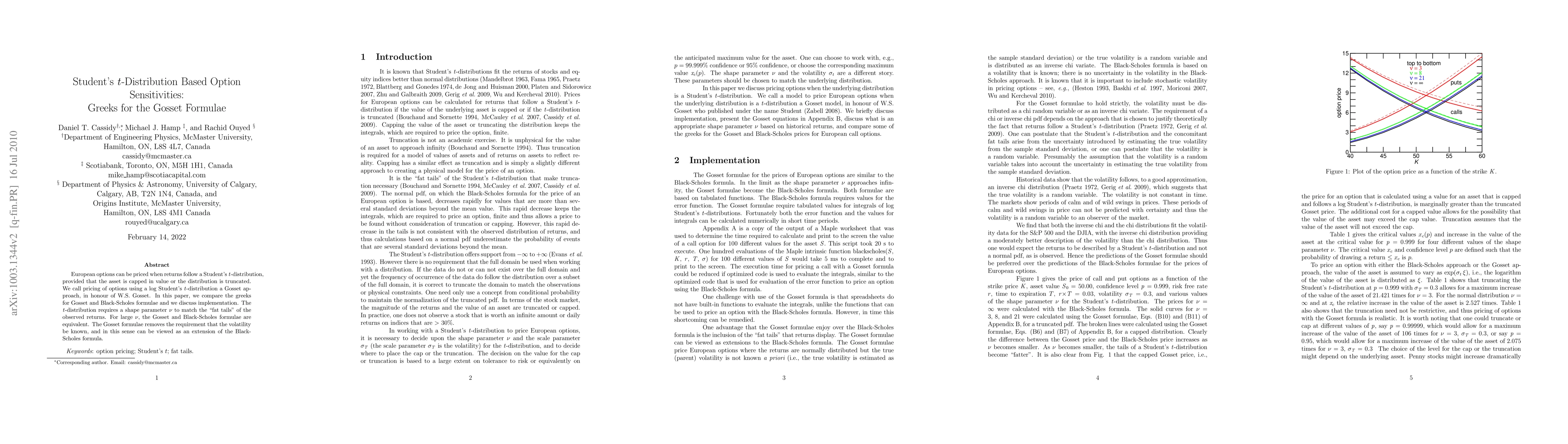

Summary

European options can be priced when returns follow a Student's t-distribution, provided that the asset is capped in value or the distribution is truncated. We call pricing of options using a log Student's t-distribution a Gosset approach, in honour of W.S. Gosset. In this paper, we compare the greeks for Gosset and Black-Scholes formulae and we discuss implementation. The t-distribution requires a shape parameter \nu to match the "fat tails" of the observed returns. For large \nu, the Gosset and Black-Scholes formulae are equivalent. The Gosset formulae removes the requirement that the volatility be known, and in this sense can be viewed as an extension of the Black-Scholes formula.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)