Summary

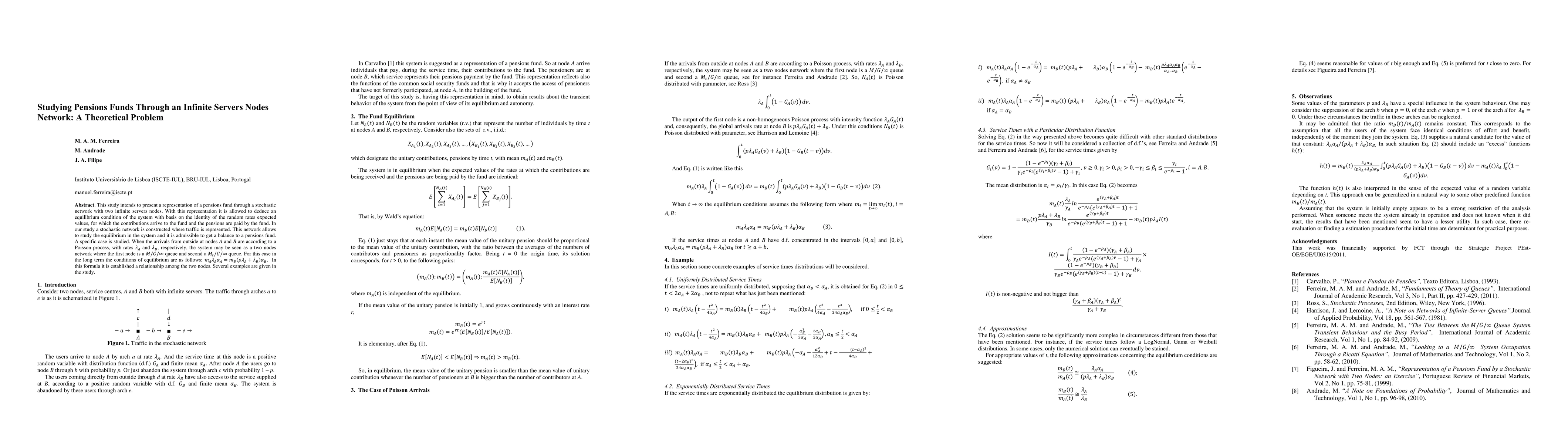

This study intends to present a representation of a pensions fund through a stochastic network with two infinite servers nodes. With this representation it is allowed to deduce an equilibrium condition of the system with basis on the identity of the random rates expected values, for which the contributions arrive to the fund and the pensions are paid by the fund. In our study a stochastic network is constructed where traffic is represented. This network allows to study the equilibrium in the system and it is admissible to get a balance to a pensions fund. A specific case is studied. When the arrivals from outside at two nodes are according to Poisson processes, the system may be seen as a two nodes network where the first node is a MGinf queue and second a MtGinf queue. For this case in the long term the conditions of equilibrium are given by a very simple formula. In this formula it is established a relationship among the two nodes. Several examples are given in the study.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)