Summary

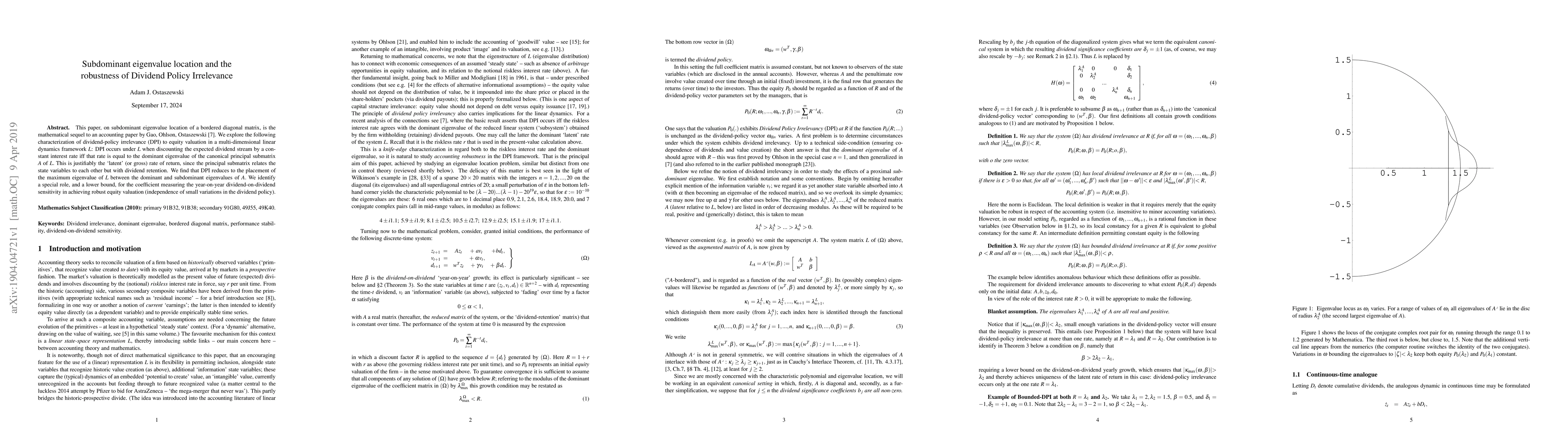

This paper, on subdominant eigenvalue location of a bordered diagonal matrix, is the mathematical sequel to an accounting paper by Gao, Ohlson, Ostaszewski \cite{GaoOO}. We explore the following characterization of dividend-policy irrelevance (DPI) to equity valuation in a multi-dimensional linear dynamics framework $L$: DPI occurs under $L$ when discounting the expected dividend stream by a constant interest rate iff that rate is equal to the dominant eigenvalue of the canonical principal submatrix $A$ of $L.$ This is justifiably the `latent' (or gross) rate of return, since the principal submatrix relates the state variables to each other but with dividend retention. We find that DPI reduces to the placement of the maximum eigenvalue of $L$ between the dominant and subdominant eigenvalues of $A.$ We identify a special role, and a lower bound, for the coefficient measuring the year-on-year dividend-on-dividend sensitivity in achieving robust equity valuation (independence of small variations in the dividend policy).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust dividend policy: Equivalence of Epstein-Zin and Maenhout preferences

Kexin Chen, Kyunghyun Park, Hoi Ying Wong

Robustness of chiral surface current and subdominant $s$-wave Cooper pairs

Shu-Ichiro Suzuki, Alexander A. Golubov

| Title | Authors | Year | Actions |

|---|

Comments (0)