Summary

In this work we derive a variant of the classic Glivenko-Cantelli Theorem, which asserts uniform convergence of the empirical Cumulative Distribution Function (CDF) to the CDF of the underlying distribution. Our variant allows for tighter convergence bounds for extreme values of the CDF. We apply our bound in the context of revenue learning, which is a well-studied problem in economics and algorithmic game theory. We derive sample-complexity bounds on the uniform convergence rate of the empirical revenues to the true revenues, assuming a bound on the $k$th moment of the valuations, for any (possibly fractional) $k>1$. For uniform convergence in the limit, we give a complete characterization and a zero-one law: if the first moment of the valuations is finite, then uniform convergence almost surely occurs; conversely, if the first moment is infinite, then uniform convergence almost never occurs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

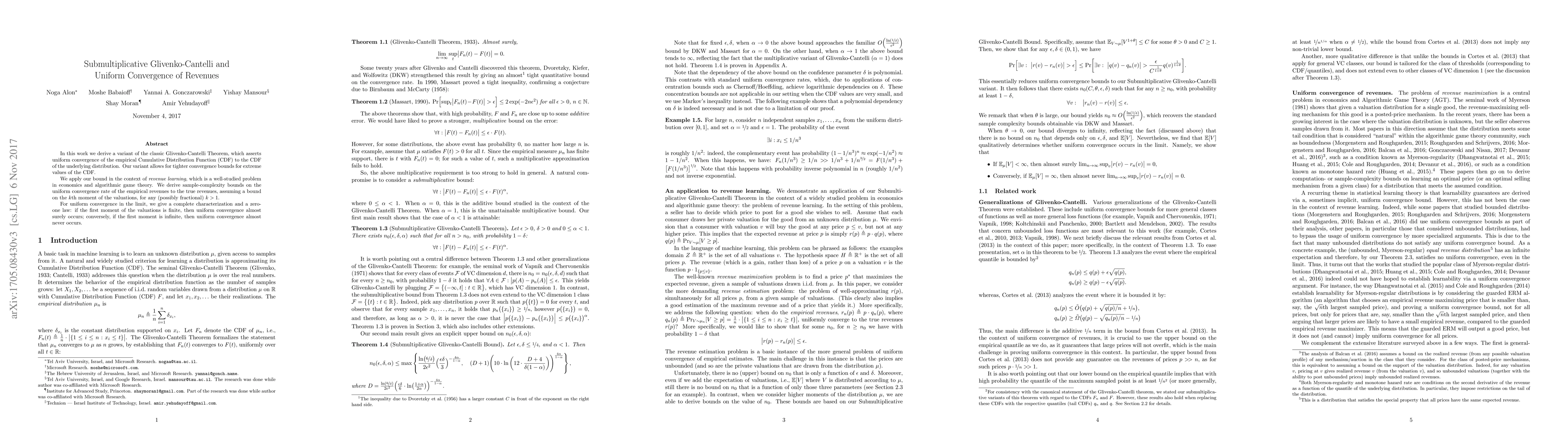

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)