Summary

Contrary to the common view that exact pricing is prohibitive owing to the curse of dimensionality, this study proposes an efficient and unified method for pricing options under multivariate Black-Scholes-Merton (BSM) models, such as the basket, spread, and Asian options. The option price is expressed as a quadrature integration of analytic multi-asset BSM prices under a single Brownian motion. Then the state space is rotated in such a way that the quadrature requires much coarser nodes than it would otherwise or low varying dimensions are reduced. The accuracy and efficiency of the method is illustrated through various numerical experiments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

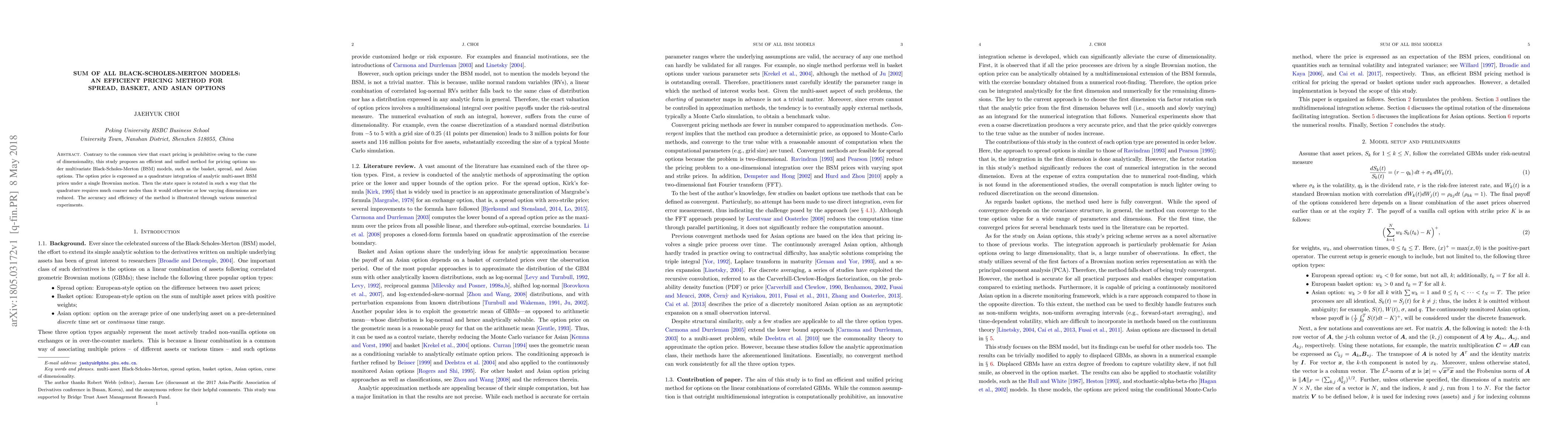

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)