Summary

In nature or societies, the power-law is present ubiquitously, and then it is important to investigate the mathematical characteristics of power-laws in the recent era of big data. In this paper we prove the superposition of non-identical stochastic processes with power-laws converges in density to a unique stable distribution. This property can be used to explain the universality of stable laws such that the sums of the logarithmic return of non-identical stock price fluctuations follow stable distributions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

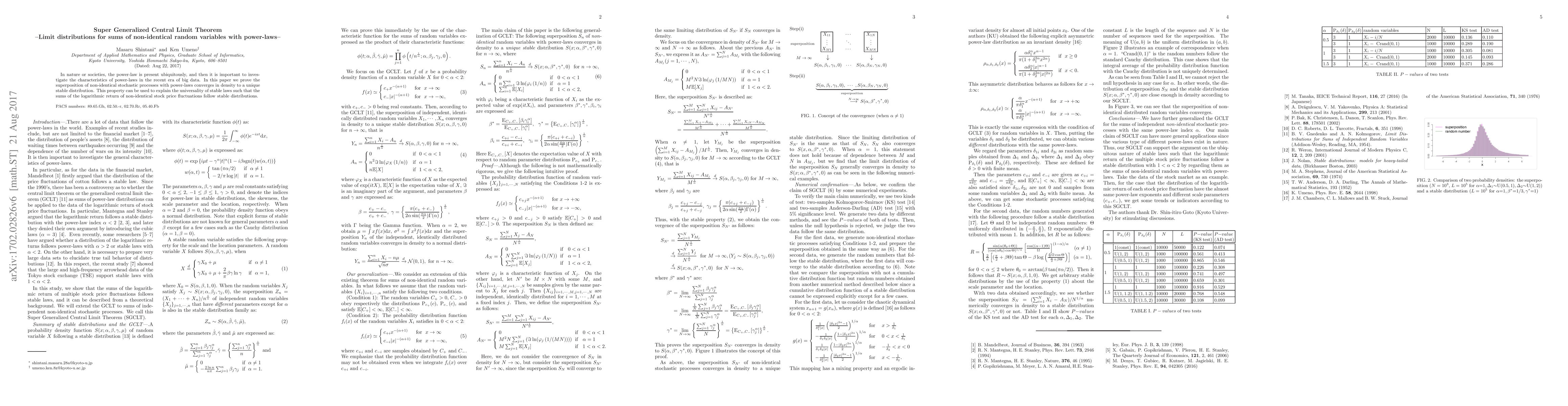

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)