Summary

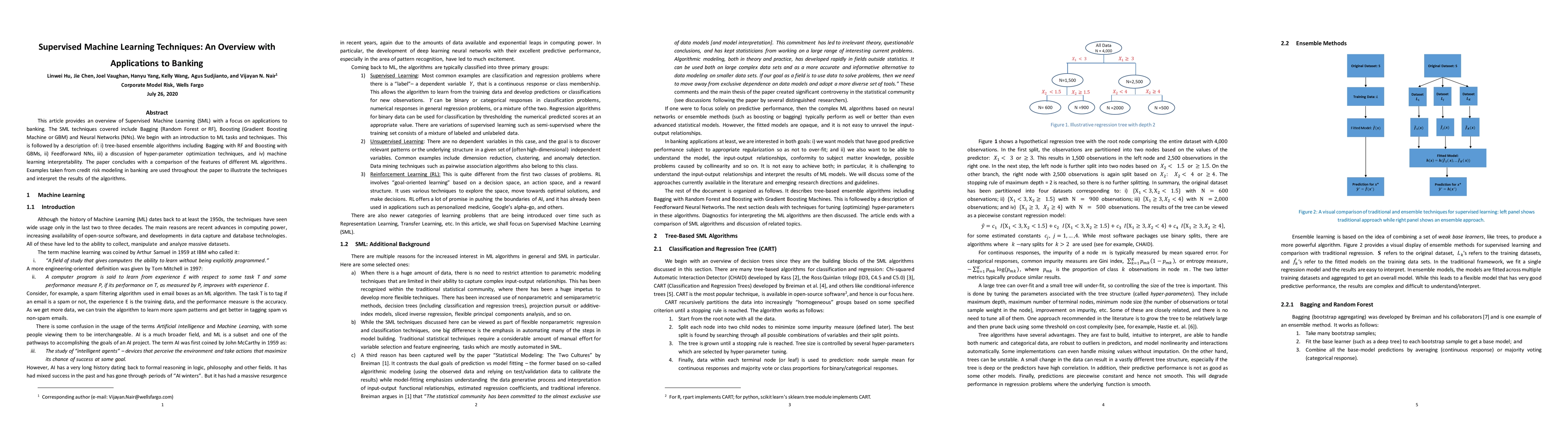

This article provides an overview of Supervised Machine Learning (SML) with a focus on applications to banking. The SML techniques covered include Bagging (Random Forest or RF), Boosting (Gradient Boosting Machine or GBM) and Neural Networks (NNs). We begin with an introduction to ML tasks and techniques. This is followed by a description of: i) tree-based ensemble algorithms including Bagging with RF and Boosting with GBMs, ii) Feedforward NNs, iii) a discussion of hyper-parameter optimization techniques, and iv) machine learning interpretability. The paper concludes with a comparison of the features of different ML algorithms. Examples taken from credit risk modeling in banking are used throughout the paper to illustrate the techniques and interpret the results of the algorithms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Overview of Machine Learning Techniques for Radiowave Propagation Modeling

Aristeidis Seretis, Costas D. Sarris

Signal Processing and Machine Learning Techniques for Terahertz Sensing: An Overview

Hayssam Dahrouj, Tareq Y. Al-Naffouri, Hadi Sarieddeen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)