Summary

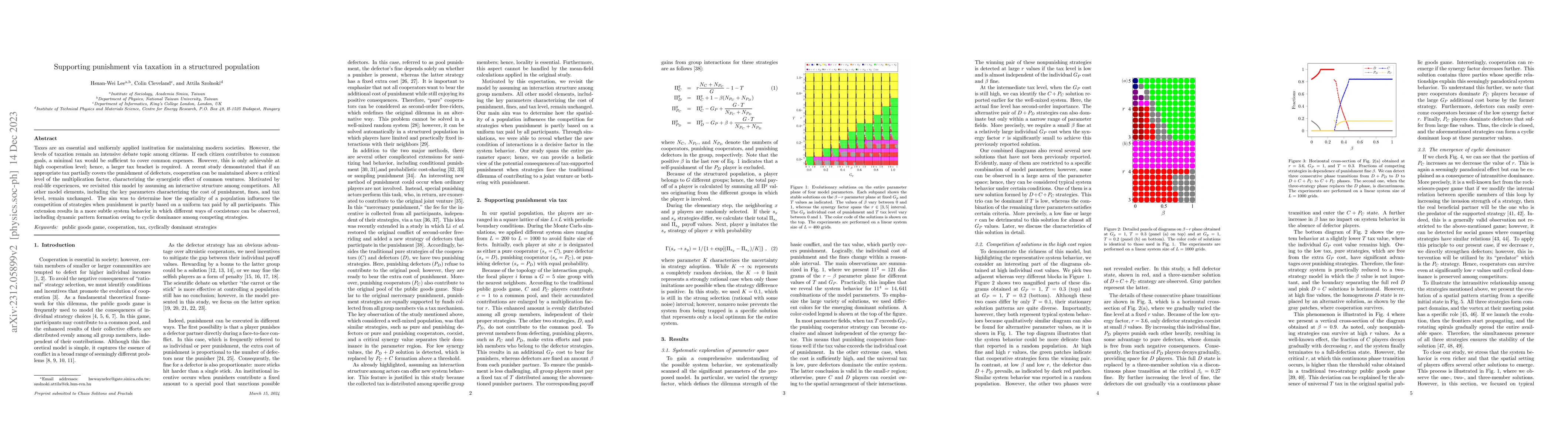

Taxes are an essential and uniformly applied institution for maintaining modern societies. However, the levels of taxation remain an intensive debate topic among citizens. If each citizen contributes to common goals, a minimal tax would be sufficient to cover common expenses. However, this is only achievable at high cooperation level; hence, a larger tax bracket is required. A recent study demonstrated that if an appropriate tax partially covers the punishment of defectors, cooperation can be maintained above a critical level of the multiplication factor, characterizing the synergistic effect of common ventures. Motivated by real-life experiences, we revisited this model by assuming an interactive structure among competitors. All other model elements, including the key parameters characterizing the cost of punishment, fines, and tax level, remain unchanged. The aim was to determine how the spatiality of a population influences the competition of strategies when punishment is partly based on a uniform tax paid by all participants. This extension results in a more subtle system behavior in which different ways of coexistence can be observed, including dynamic pattern formation owing to cyclic dominance among competing strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)