Summary

We use the theory of coherent measures to look at the problem of surplus sharing in an insurance business. The surplus share of an insured is calculated by the surplus premium in the contract. The theory of coherent risk measures and the resulting capital allocation gives a way to divide the surplus between the insured and the capital providers, i.e. the shareholders.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

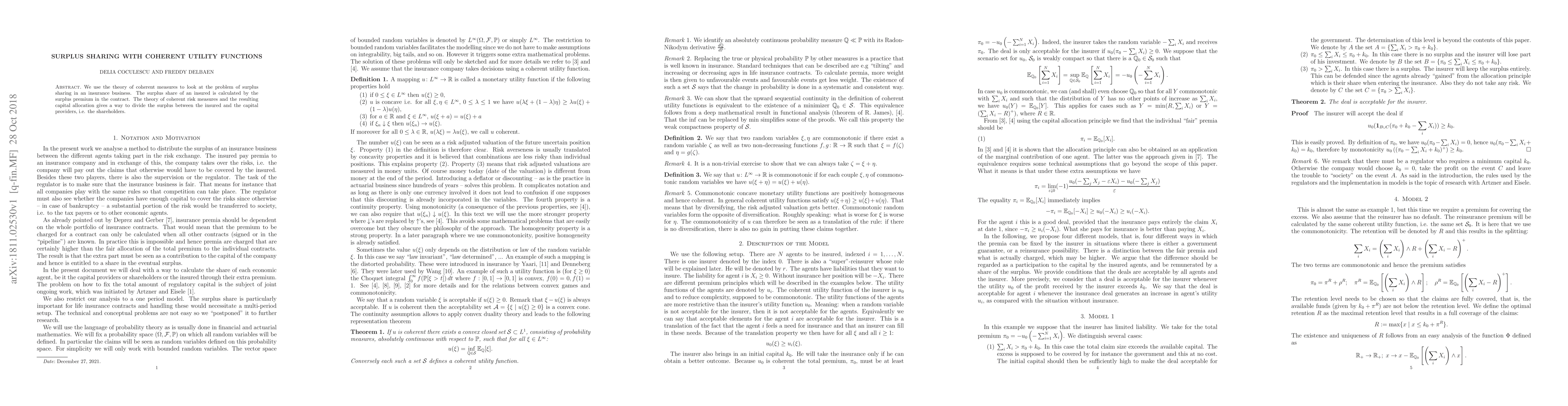

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Mechanisms for Consumer Surplus Maximization

Tomer Ezra, Ariel Shaulker, Daniel Schoepflin

| Title | Authors | Year | Actions |

|---|

Comments (0)