Summary

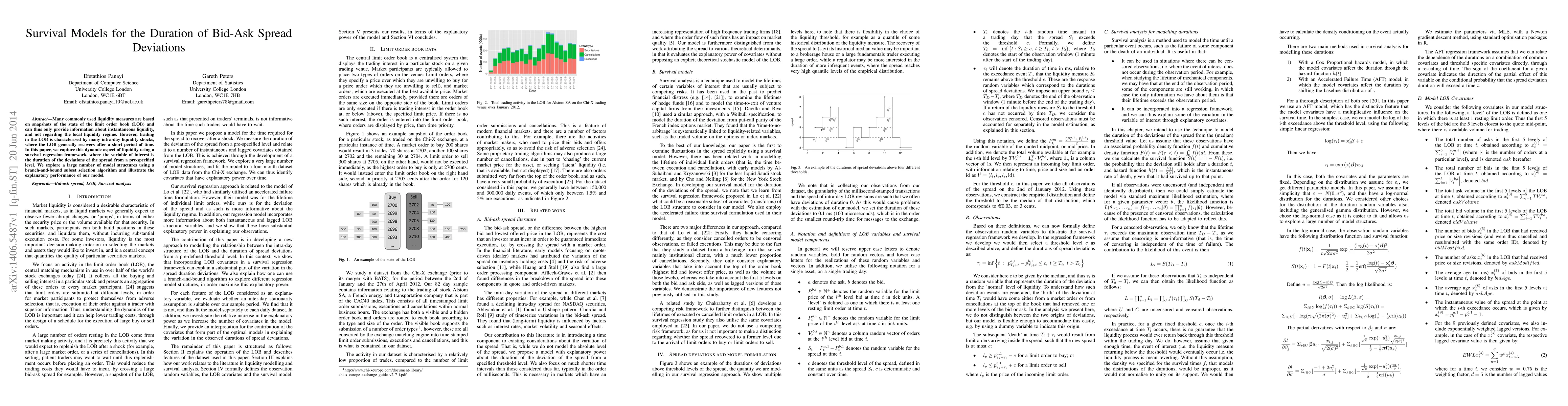

Many commonly used liquidity measures are based on snapshots of the state of the limit order book (LOB) and can thus only provide information about instantaneous liquidity, and not regarding the local liquidity regime. However, trading in the LOB is characterised by many intra-day liquidity shocks, where the LOB generally recovers after a short period of time. In this paper, we capture this dynamic aspect of liquidity using a survival regression framework, where the variable of interest is the duration of the deviations of the spread from a pre-specified level. We explore a large number of model structures using a branch-and-bound subset selection algorithm and illustrate the explanatory performance of our model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)