Summary

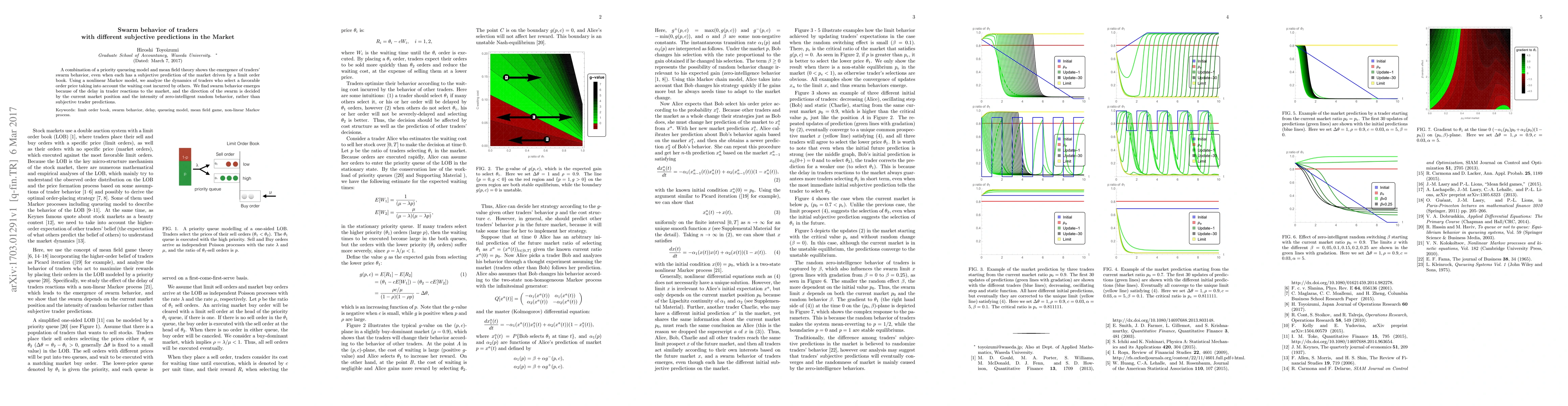

A combination of a priority queueing model and mean field theory shows the emergence of traders' swarm behavior, even when each has a subjective prediction of the market driven by a limit order book. Using a nonlinear Markov model, we analyze the dynamics of traders who select a favorable order price taking into account the waiting cost incurred by others. We find swarm behavior emerges because of the delay in trader reactions to the market, and the direction of the swarm is decided by the current market position and the intensity of zero-intelligent random behavior, rather than subjective trader predictions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket Making with Fads, Informed, and Uninformed Traders

Leandro Sánchez-Betancourt, Emilio Barucci, Adrien Mathieu

No citations found for this paper.

Comments (0)