Summary

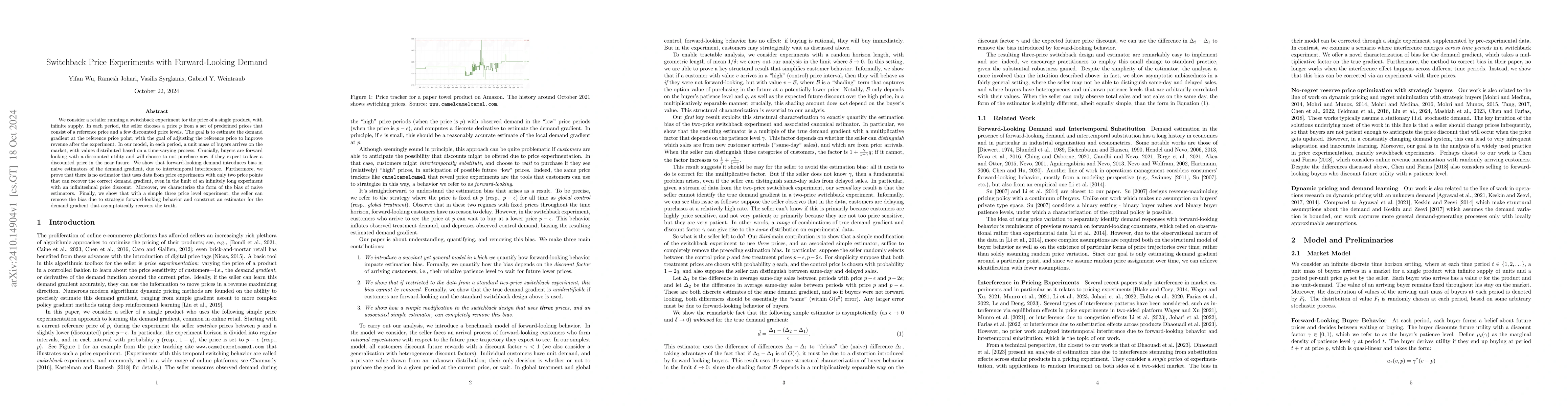

We consider a retailer running a switchback experiment for the price of a single product, with infinite supply. In each period, the seller chooses a price $p$ from a set of predefined prices that consist of a reference price and a few discounted price levels. The goal is to estimate the demand gradient at the reference price point, with the goal of adjusting the reference price to improve revenue after the experiment. In our model, in each period, a unit mass of buyers arrives on the market, with values distributed based on a time-varying process. Crucially, buyers are forward looking with a discounted utility and will choose to not purchase now if they expect to face a discounted price in the near future. We show that forward-looking demand introduces bias in naive estimators of the demand gradient, due to intertemporal interference. Furthermore, we prove that there is no estimator that uses data from price experiments with only two price points that can recover the correct demand gradient, even in the limit of an infinitely long experiment with an infinitesimal price discount. Moreover, we characterize the form of the bias of naive estimators. Finally, we show that with a simple three price level experiment, the seller can remove the bias due to strategic forward-looking behavior and construct an estimator for the demand gradient that asymptotically recovers the truth.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper employs a switchback pricing experiment model with forward-looking demand, analyzing buyer behavior under varying discounted price levels over time.

Key Results

- Forward-looking demand introduces bias in naive estimators of the demand gradient.

- No two-point price experiment can recover the correct demand gradient asymptotically.

- A three-price level experiment removes bias due to strategic forward-looking behavior and constructs an unbiased estimator.

- An unbiased estimator can be constructed even without tracking buyer arrival times.

- The static demand gradient remains relevant for reference price adjustments under constant experimentation.

Significance

This research is significant for retailers and pricing strategists, providing insights into accurately estimating demand gradients in dynamic pricing scenarios, which can lead to improved revenue management.

Technical Contribution

The paper proves the existence of bias in naive estimators for forward-looking demand and presents a three-price level experiment design to construct an asymptotically unbiased estimator.

Novelty

The novelty lies in demonstrating the impossibility of unbiased estimation with only two price points and providing a solution with three price levels, addressing the bias induced by forward-looking consumer behavior.

Limitations

- The model assumes infinite supply and a single product.

- Results are based on theoretical proofs and may not fully capture real-world complexities.

Future Work

- Investigate the practical implementation and empirical validation of the proposed estimator.

- Extend the model to incorporate more complex demand dynamics and product categories.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDesign and Analysis of Switchback Experiments

David Simchi-Levi, Iavor Bojinov, Jinglong Zhao

Dynamic Factor Models with Forward-Looking Views

Anas Abdelhakmi, Andrew E. B. Lim

No citations found for this paper.

Comments (0)