Summary

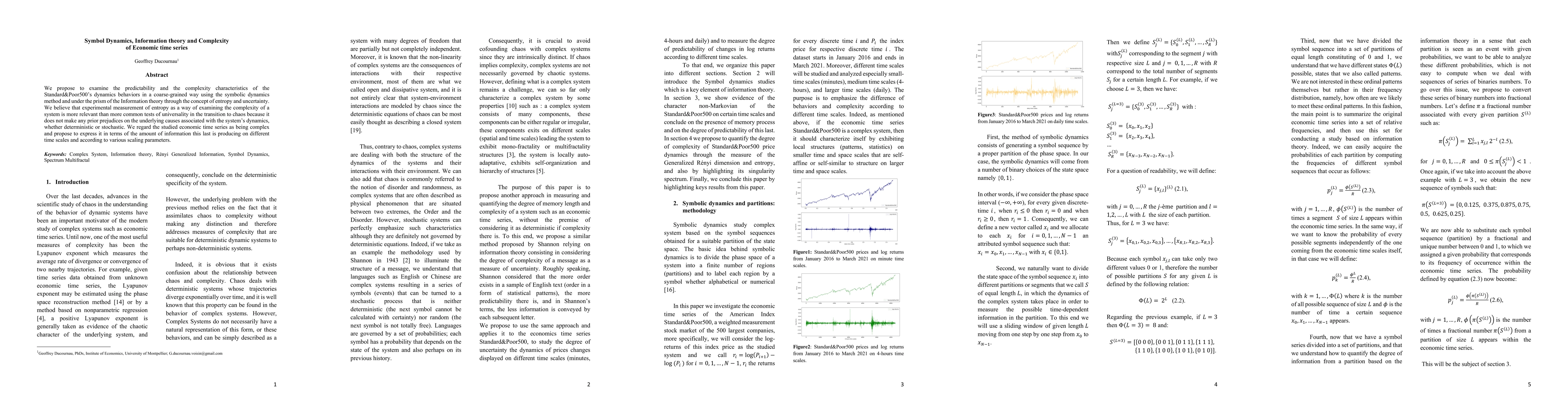

We propose to examine the predictability and the complexity characteristics of the Standard&Poor500 dynamics behaviors in a coarse-grained way using the symbolic dynamics method and under the prism of the Information theory through the concept of entropy and uncertainty. We believe that experimental measurement of entropy as a way of examining the complexity of a system is more relevant than more common tests of universality in the transition to chaos because it does not make any prior prejudices on the underlying causes associated with the system dynamics, whether deterministic or stochastic. We regard the studied economic time series as being complex and propose to express it in terms of the amount of information this last is producing on different time scales and according to various scaling parameters.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSynthetic Series-Symbol Data Generation for Time Series Foundation Models

Wenxuan Wang, Kai Wu, Xiaoyu Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)